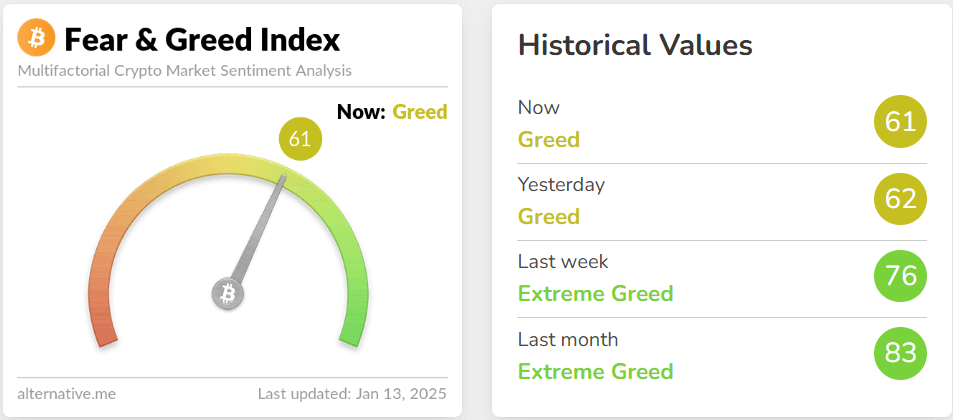

- The crypto market trended lower last week, driven largely by risk-off sentiments on newly released Fed meeting notes and economic data

- The Fed expressed caution around inflation, especially as President-elect Donald Trump’s policies will kick in after his inauguration on January 20

- Meanwhile, spot crypto exchange-traded funds (ETFs) logged outflows from Wednesday, January 8

Bitcoin

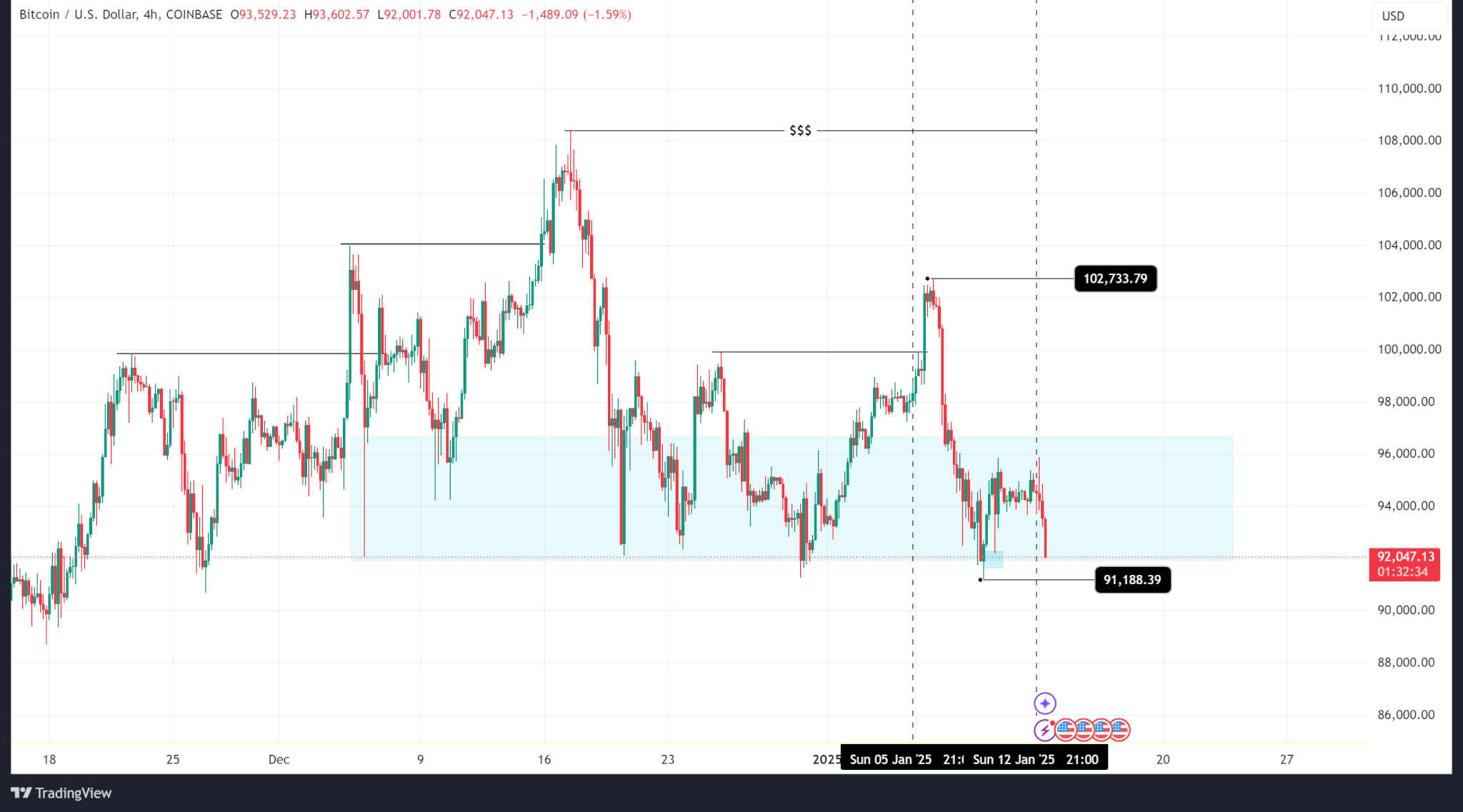

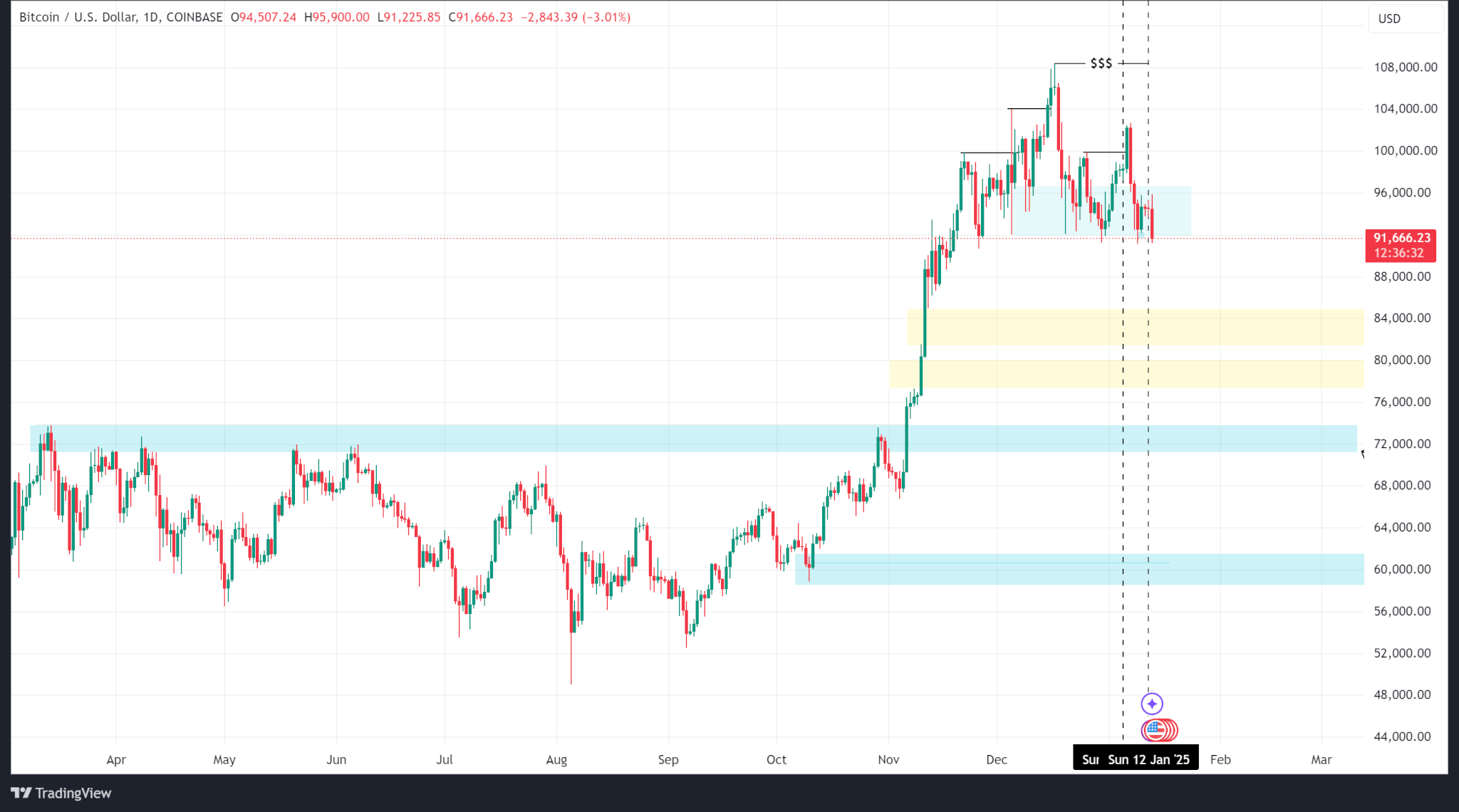

Bitcoin’s price logged a negative week falling from a high of $102,733 to a low of $91,188 before eventually closing at $94,547.

Technical analysis shows a break above the last lower high and a push back down into the H4 demand zone, which means that although the price took a bearish turn, it is still in overall bullish territory.

Much of this bearish sentiment is driven by bleak economic expectations. The US Federal Reserve meeting minutes, released on January 8, showed that the reserve bank is cautious about inflation it expects will follow President-elect Donald Trump’s policies.

As such, the likelihood of continued rate cuts has dwindled, with some analysts seeing an end to cuts early this year. The market’s reaction reflects this updated risk-off sentiment.

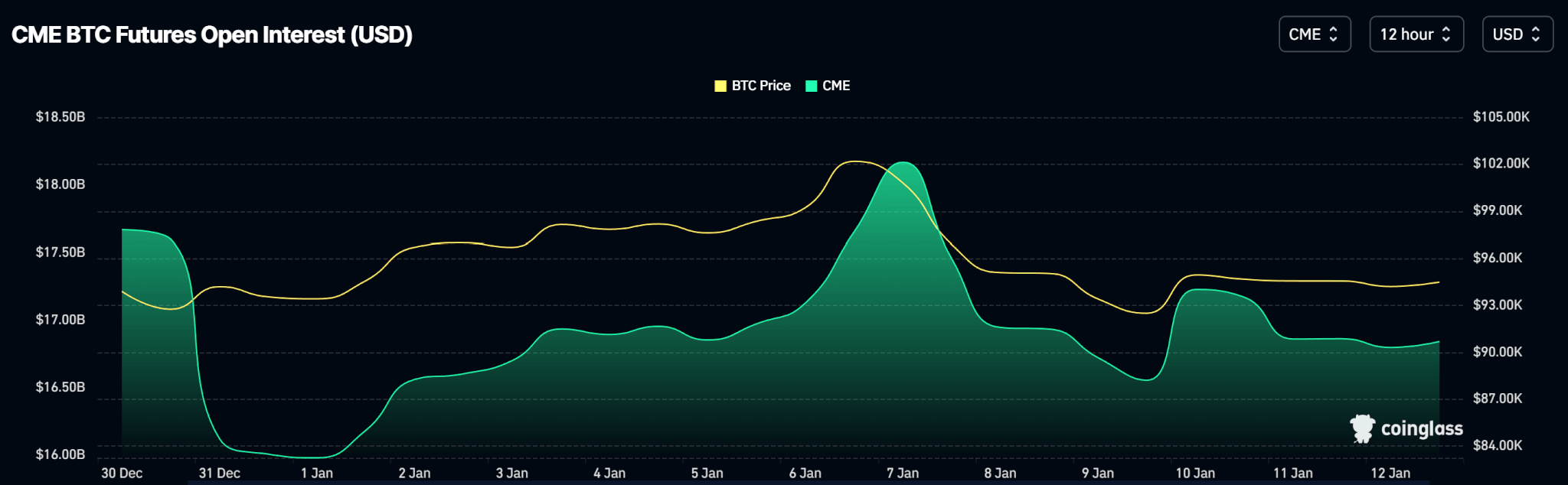

Bitcoin’s open interest chart shows a decline in open contracts between Wednesday and now. Open interest hit a weekly high on Tuesday at $18.16 billion on the CME, fell to a low on Thursday ($16.55 billion), and mellowed out the rest of the week.

Meanwhile, spot Bitcoin ETFs logged outflows after the release of the Fed’s meeting minutes on Wednesday. Outflows totalled $718.20 million while inflows totalled $1.03 billion.

Outlook

Bitcoin’s price currently hovers around the bottom of the demand zone. If it breaks below, its price could be pushed down to $85,100 where a fair value gap could act as support.

BTC trades at $91,622 as of publishing.

Ethereum

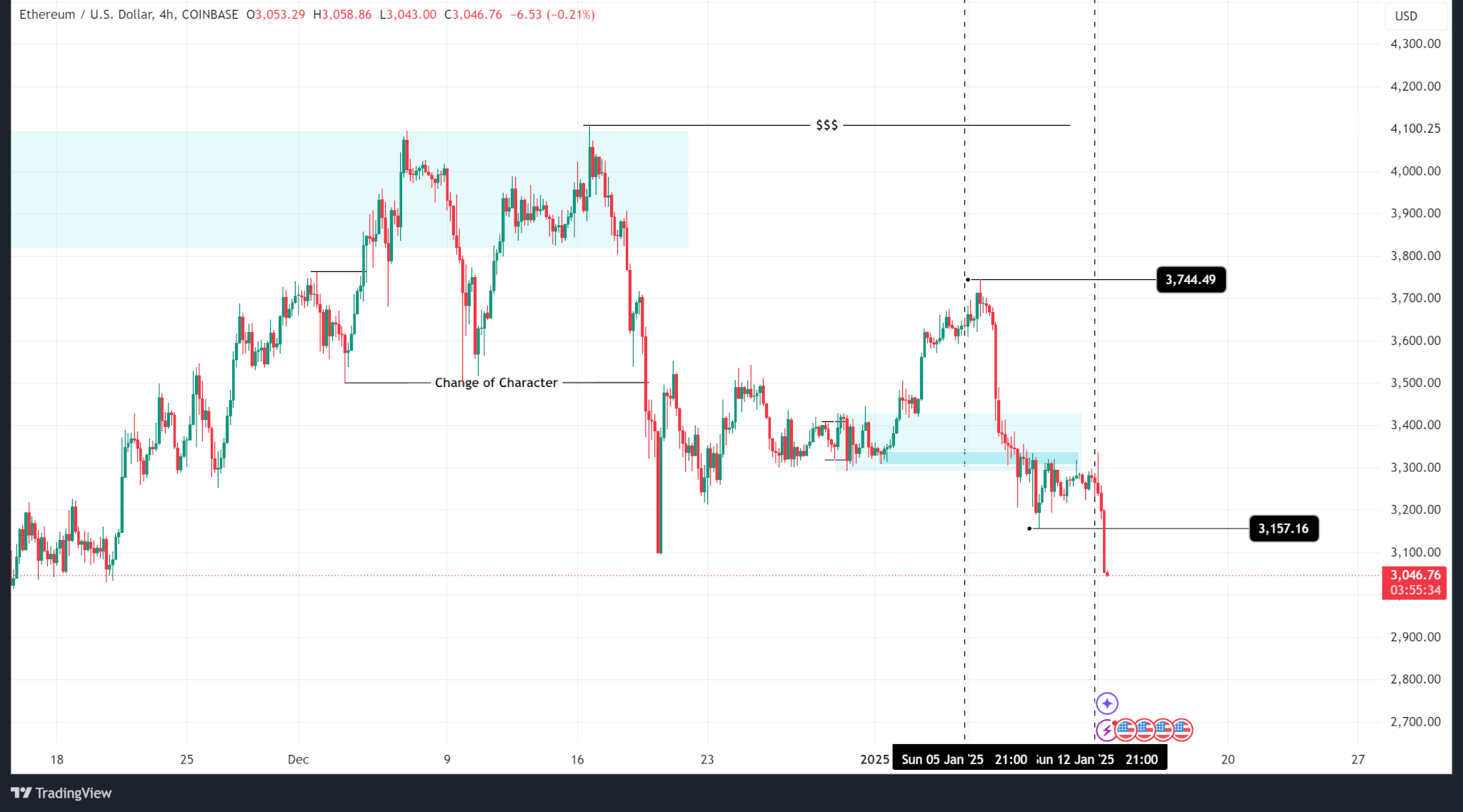

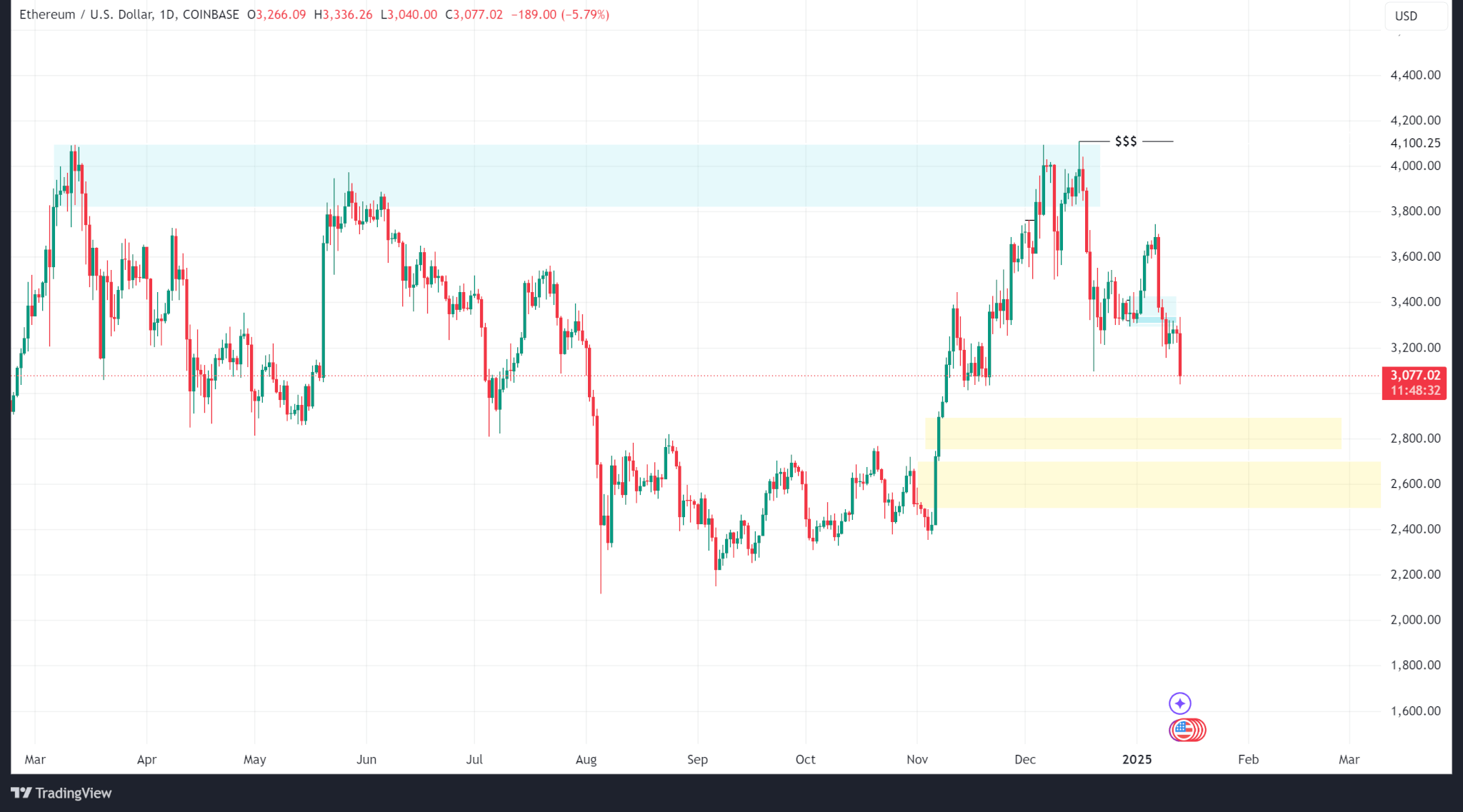

Ethereum’s price also logged a negative week, falling from a high of $3,744 to a low of $3,157 before closing at $3,236. ETH price action tested March 2024’s high of $4,089 in early December 2024, but failed to break above and has been logging lower lows since.

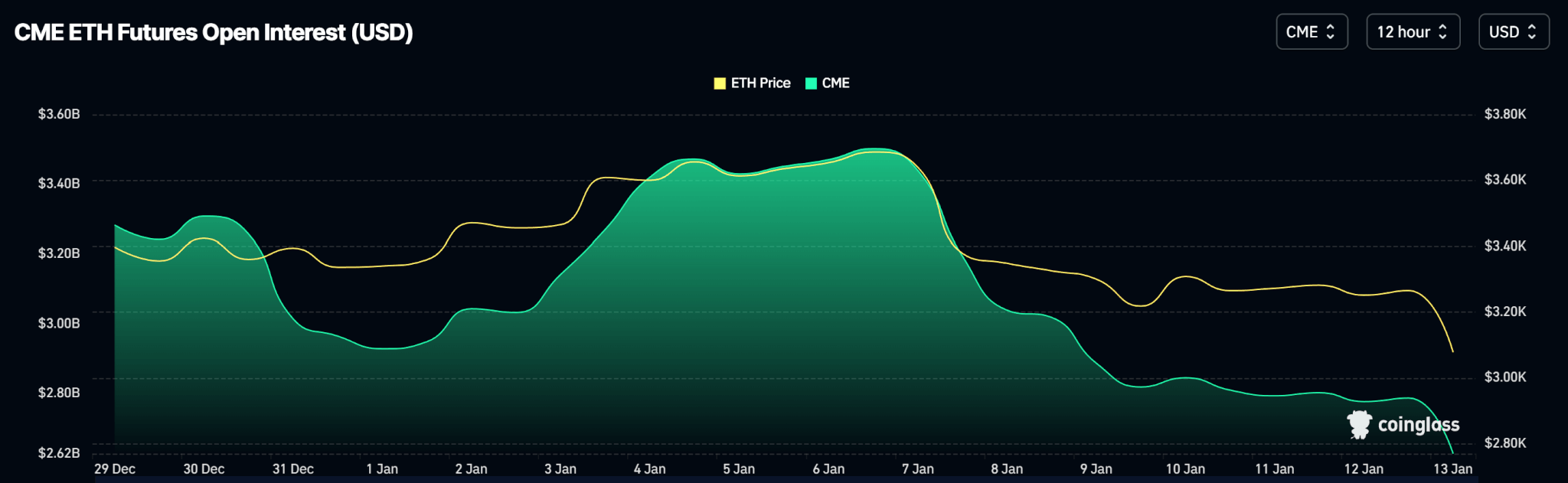

Open interest dropped from a January 7 high of $3.50 billion and continued to decline until it was $2.63 billion as of this publication.

Meanwhile, Ethereum spot ETFs logged a weekly net outflow of $186.00 million following risk-off sentiments in the market.

Outlook

As Ethereum’s price continues to trend lower, the next technical level that could provide support is the fair value gap at the $2,893 price level.

ETH trades at $3,071 as of publishing.

Solana

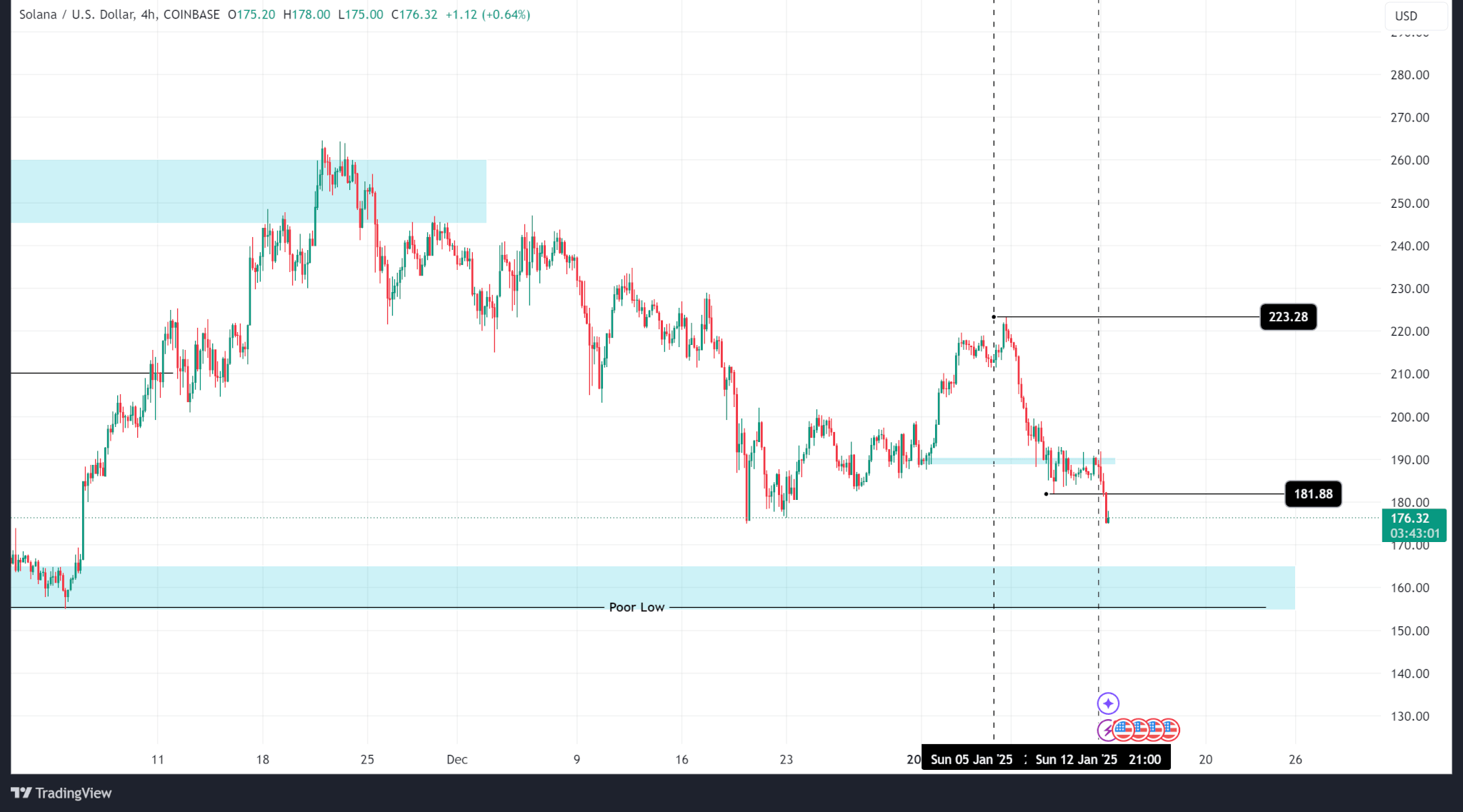

Solana’s price fell from a weekly high of $223 to a weekly low of $181 before eventually closing at $188, logging a total loss of 12.53%. SOL continues to trend lower after failing to close above its all-time high of $260.

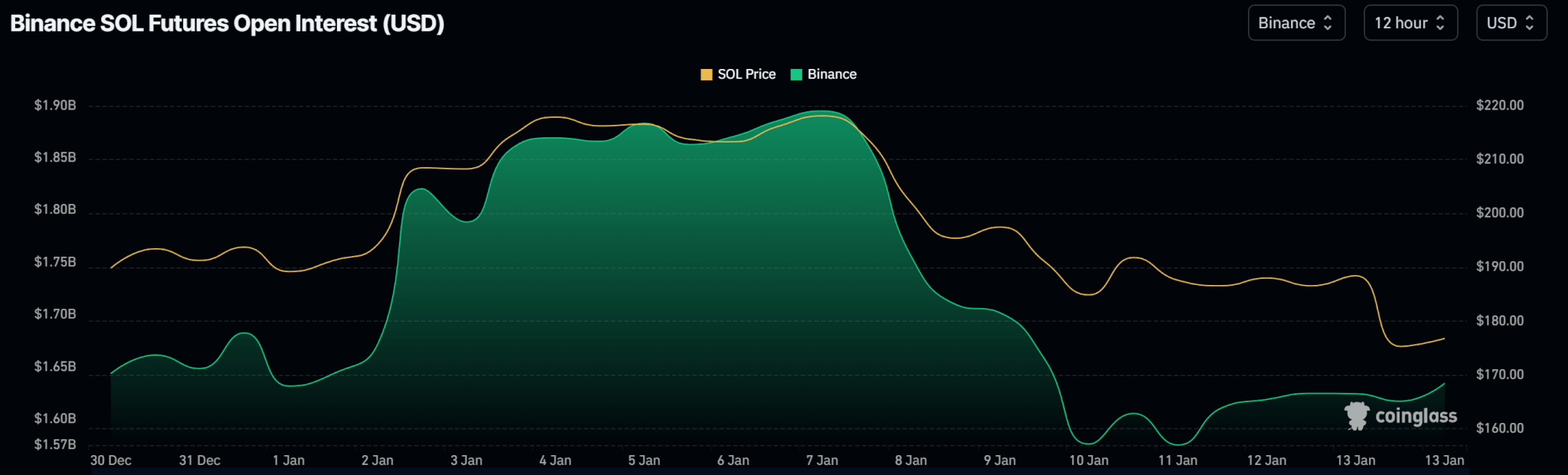

Open interest data shows a steep fall from $1.89 billion on Binance on January 7 to $1.58 billion on January 10. As of this publication, OI levels have improved to $1.63 billion.

Outlook

The next technical support zone is at the $164 price level. However, although the order block is a support, it is a poor low that could be taken out even if price reverses from that zone.

SOL trades at $176 as of publishing.

Ripple

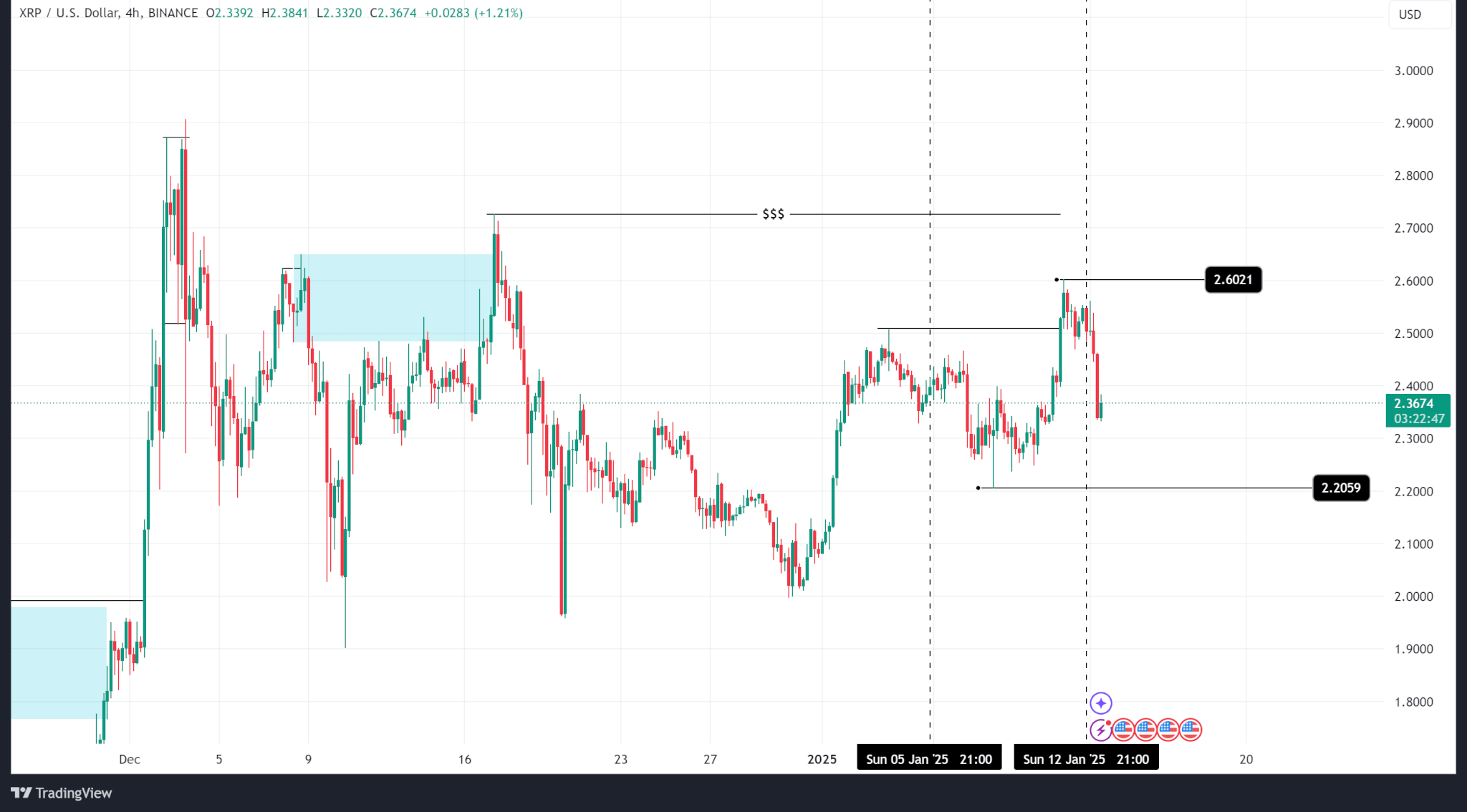

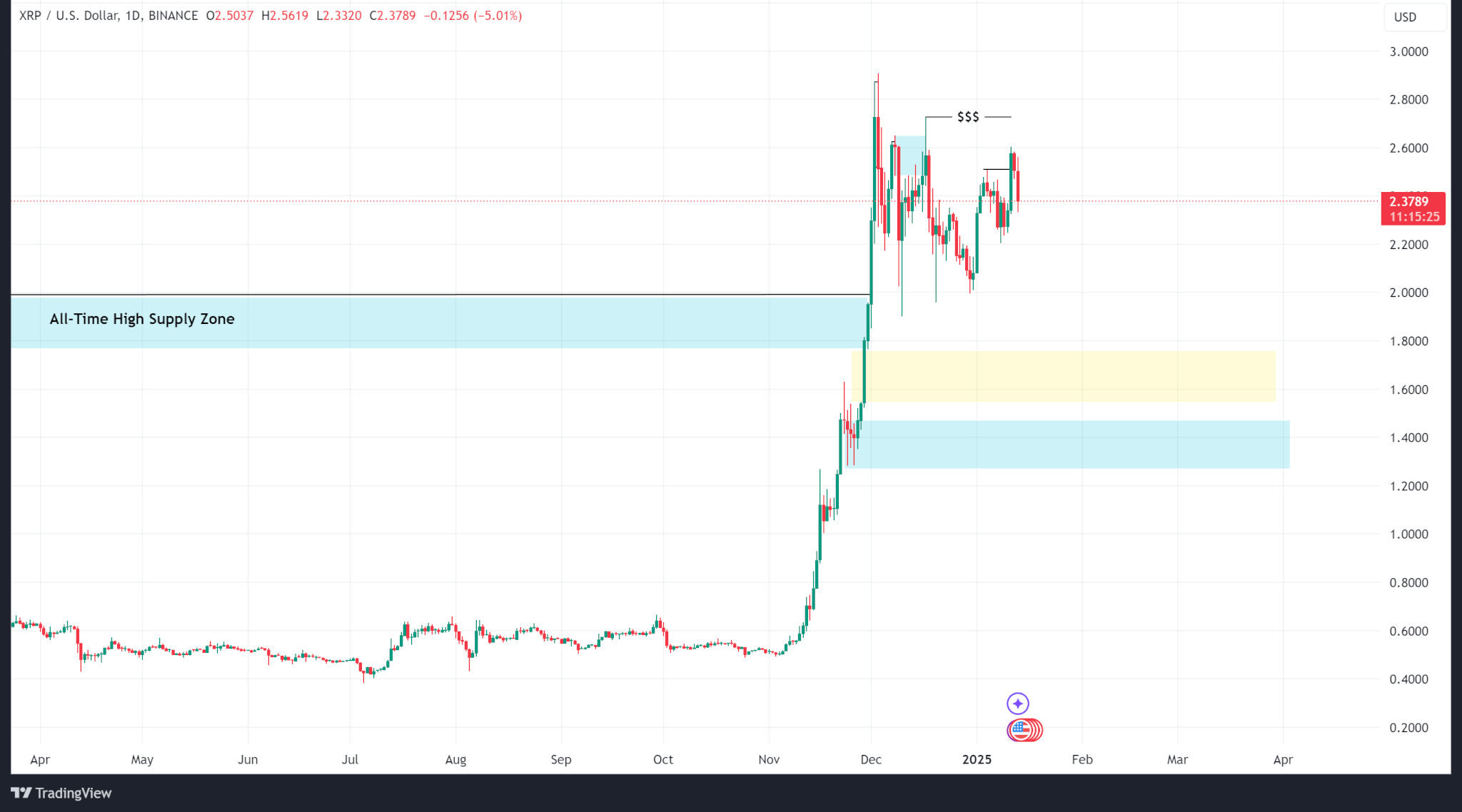

Ripple’s price fared better last week, closing higher at $2.55 from $2.38 at the start of the week as its price continued to log higher highs. Zooming out, the price continues to range between $1.90 and $2.90 as the market cools.

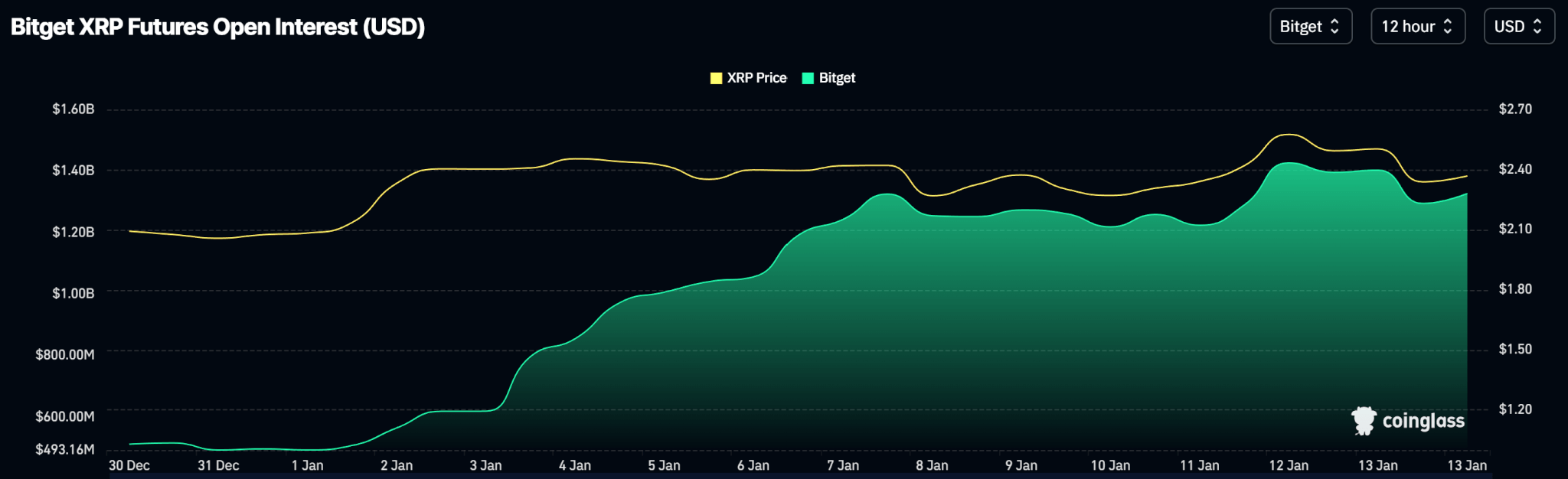

Open interest rose on Bitget, the exchange with the highest XRP derivative trading volume, over the last week, supporting upward price movement as positive news around Ripple’s case with the SEC boosted sentiments.

Outlook

Ripple’s price is buoyed by news around the SEC’s lawsuit against its parent company, a case which could be thrown out with the outgoing administration.

However, technical analysis shows that XRP trades at a premium and a pullback is expected. The most likely levels are the fair value gap at $1.75 and the order block at $1.46.

XRP trades at $2.37 as of publishing.