Mastercard Head of Crypto Europe Christian Rau talks about how the company views crypto as a potential payment technology and sees benefits in stablecoins.

Summary

- Mastercard has become increasingly interested in adopting cryptocurrency into its financial system, but does not see a full transformation anytime soon.

- The firm has no plans to create a blockchain, but the possibility is present.

In an interview with Big Whale, Mastercard’s Head of Crypto Europe Christian Rau said the firm is “closely interested in crypto-assets.” The American digital payment giant has been gradually integrating web3 technology into its global payment network.

So far, the group has been deploying on-ramp and off-ramp services on cards that enable crypto holders to integrate crypto assets into the payment system.

However, it does not plan on fully transforming into a crypto-focused payment system. According to Rau, crypto is simply a potential payment technology, not a revolution. Rau stated that its current strategy is going to prioritize “safe and compliant payments.” And crypto is now one of them.

“Our strategy hasn’t changed in 50 years: enable people to pay and businesses to be paid, in a safe and compliant manner,” explains Rau in a translated post shared by The Big Whale journalist, Grégory Raymond.

“Crypto fits into this logic. We are not seeking to reinvent the system but to enrich it,” he added.

At the moment, the firm does not have any concrete plans to build its own blockchain. But the option is not completely off the table.

“We prioritize interoperability with existing solutions. But if none meet our needs, we could consider it,” he said.

Moreover, Rau mentioned a few of the company’s recent collaborations with crypto firms like MetaMask, Bitget, MoonPay, Kraken and more. Mastercard became the foundation for crypto firms to tap into merchants that support card payments, allowing crypto holders to make crypto payments at offline and online stores.

Rau said that for crypto, which is a fairly new technology for Mastercard, the implementation becomes more complex when it comes to non-custodial wallets.

“With MetaMask, we had to create an architecture where a smart contract verifies the availability of funds in real time,” he said.

How Mastercard views the stablecoin wave

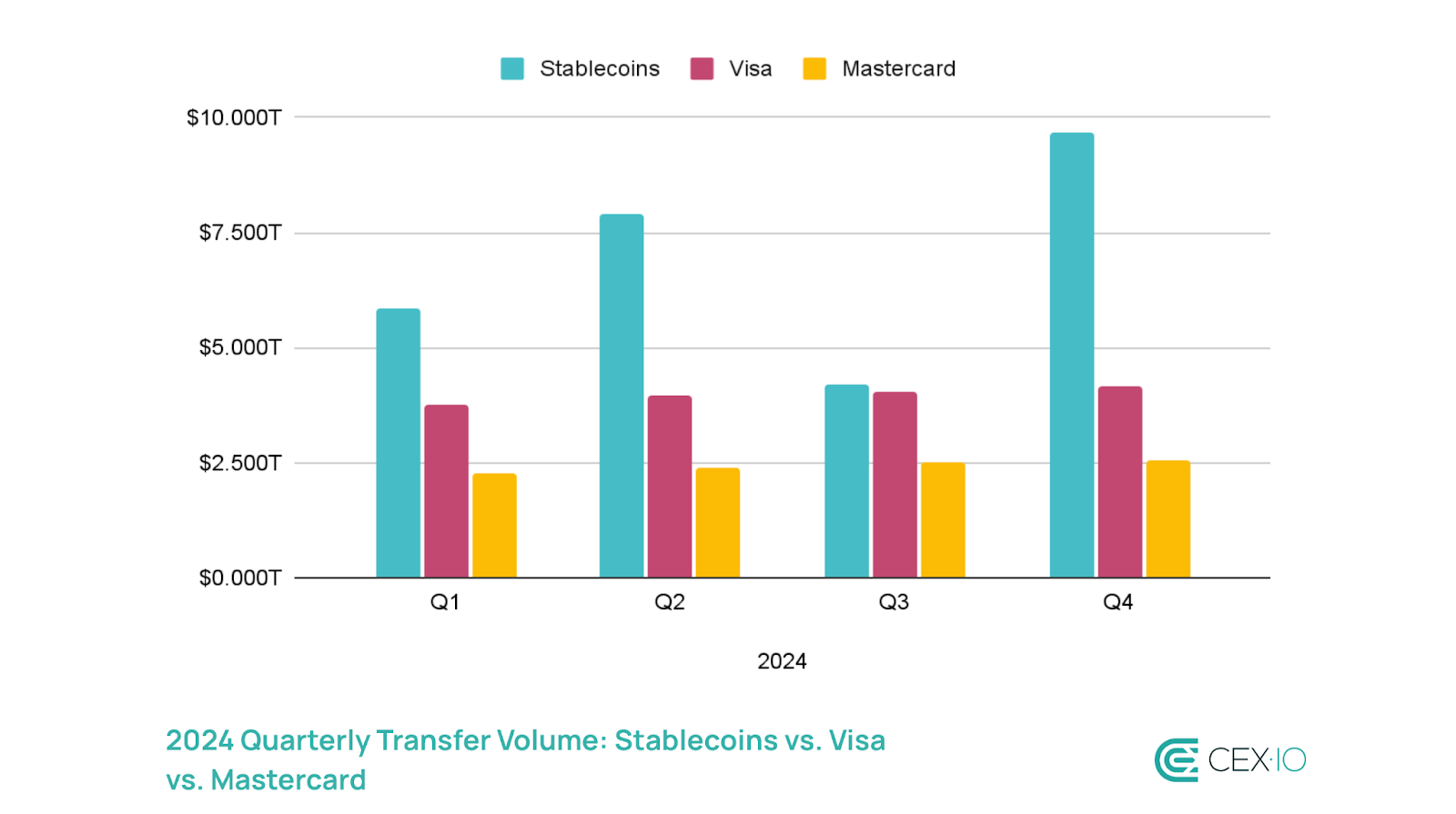

Most recently, the firm has been observing the stablecoin wave with interest. Rau considers stablecoins as a useful technology to process transactions faster and improve cross-border settlements. In fact, stablecoin transaction volumes have surpassed Mastercard’s volumes.

In 2024, the total stablecoin transaction volume reached approximately $27.6 trillion, surpassing the combined transaction volume of both Visa and Mastercard.

On the other hand, he believes stablecoins cannot fully replace traditional financial systems. Despite this, the firm does not view the adoption wave of stablecoins as competition, but as an opportunity to expand their financial payment system.

“We consider them as a settlement technology. They can improve cross-border payments or reduce exchange rate risks. But they do not replace the services we provide, such as protection in case of disputes,” said Rau.

Partnerships with stablecoin issuer Circle and payment providers like MoonPay have enabled for Mastercard to actively participate in the stablecoin wave sweeping the globe.

“Today, we already enable millions of people to spend their stablecoin balances at over 150 million Mastercard merchant locations worldwide,” wrote the company in a statement from June 2025.