The crypto market is crashing today, August 18, with Bitcoin falling below $115,000 and the total valuation of all tokens plunging below $4 trillion.

Summary

- The crypto market crash continued amid a jump in liquidations.

- Traders are eying the upcoming Jackson Hole Symposium.

- Cryptocurrencies are also falling amid profit-taking among investors.

Top altcoins like Ripple (XRP), Ethereum (ETH), Solana (SOL), and Sui (SUI) were all down by over 5%. Smaller altcoins like Raydium, Aerodrome Finance, and Bonk were among the top laggards.

Crypto market crashing amid rising liquidations

A major reason for today’s market drop is a wave of liquidations across crypto exchanges. Exchanges have been closing highly leveraged bullish trades, adding significant selling pressure to the market.

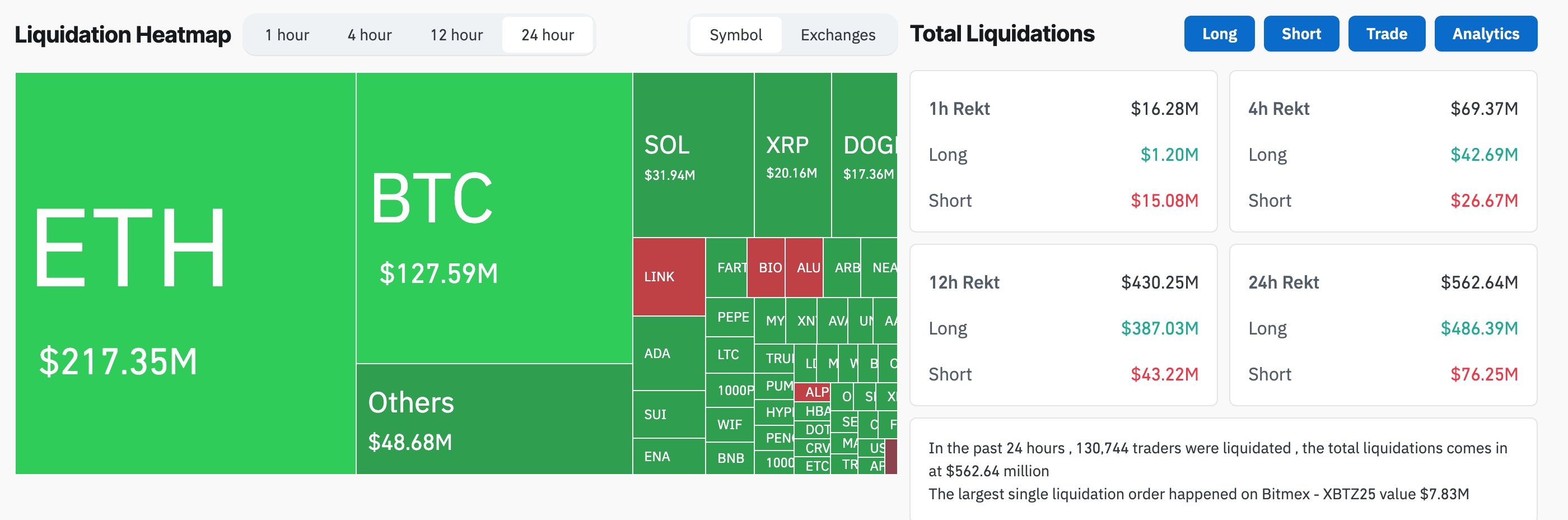

According to CoinGlass data, 24-hour liquidations surged by 327%, with over 131,000 traders liquidated. The largest single liquidation was valued at $7.83 million.

These liquidations coincided with profit-taking from investors after strong rallies across most major cryptocurrencies in recent weeks.

Upcoming Jerome Powell Jackson Hole Symposium speech

Another catalyst is the upcoming speech by Federal Reserve Chair Jerome Powell at the Jackson Hole Symposium in Wyoming, one of the most closely watched annual events for monetary policy signals.

The speech comes as market participants are paring back hopes for a cut after last week’s strong consumer and producer inflation data. The core consumer price index jumped to 3.1%, while the producer price index moved to 3.6%. Another report showed that inflation expectations continued rising.

Given this backdrop, Powell is expected to signal a more cautious, wait-and-see approach, especially as the Fed monitors the economic impact of Donald Trump’s newly implemented tariffs on major trading partners.

Technicals have contributed to the crypto crash

Technical factors have also contributed to the ongoing crash. Many altcoins had surged to overbought levels after recent rallies, diverging sharply from their historical averages.

Ethereum is a prime example. The coin hit a multi-year high of $4,785 last week, pushing its Relative Strength Index to 87.6, a level considered highly overbought. Such readings often trigger pullbacks as traders lock in profits.

Additionally, Ethereum’s price was significantly above both its 50-day and 200-day Exponential Moving Averages. The current decline may reflect a broader mean reversion trend, where assets revert back to their historical norms. Similar setups are unfolding across other altcoins as well.

Is this the end of the crypto bull run?

The ongoing crypto crash is likely not the end of the bull run as the industry has multiple catalysts. Exchange Traded Funds inflows have continued rising, and more treasury companies are coming, leading to higher demand.

Moreover, the Fed is still expected to begin cutting rates later this year, with further acceleration anticipated in 2026 when Donald Trump replaces Powell.

Most importantly, the U.S. Securities and Exchange Commission is expected to approve several crypto ETFs before the end of the year, potentially unlocking even greater institutional demand.