A closely followed crypto analyst says that one metric suggests Bitcoin (BTC) may decline to under $110,000 after losing a key support level.

In a new thread, crypto trader Ali Martinez tells his 145,400 followers on the social media platform X that Bitcoin may decline more than 7% from its current value as the flagship crypto asset declines along with the broader financial markets.

The crypto analyst looks at the Unspent Transaction Output (UTXO) Realized Price Distribution (URPD) model to determine the key support levels. The UTXO keeps track of the number of existing coins that last moved within a given price range.

“Bitcoin has lost the critical $116,950 support. All eyes now on the next major level at $107,000.”

Bitcoin is trading for $115,156 at time of writing, down 2.6% in the last 24 hours.

Next up, the analyst says that Ethereum (ETH) rival Cardano (ADA) may be printing a similar bull pattern from 2020-2021 and eventually increase to more than $5.

“Cardano is showing the same price structure as the last cycle, only this time, it’s unfolding more gradually. And it feels like we’re right at the beginning of an explosive move.”

ADA is trading for $0.73 at time of writing, down 3.8% in the last 24 hours.

Looking at decentralized oracle network Chainlink, the analyst predicts that LINK will increase to around $44.50 before the year’s end as it remains trading within the bounds of a bullish ascending channel.

“As long as Chainlink holds above the $13 support level, the bullish outlook remains intact. No reason to be bearish just yet.”

LINK is trading for $16.68 at time of writing, down 5.1% on the day.

Next up, the analyst warns that peer-to-peer file storage network Filecoin (FIL) may plummet in value after losing key support levels on the three-day chart.

“Filecoin appears to be breaking out of a channel, potentially eyeing a move to $0.89.”

FIL is trading for $2.36 at time of writing, down 4.6% in the last 24 hours.

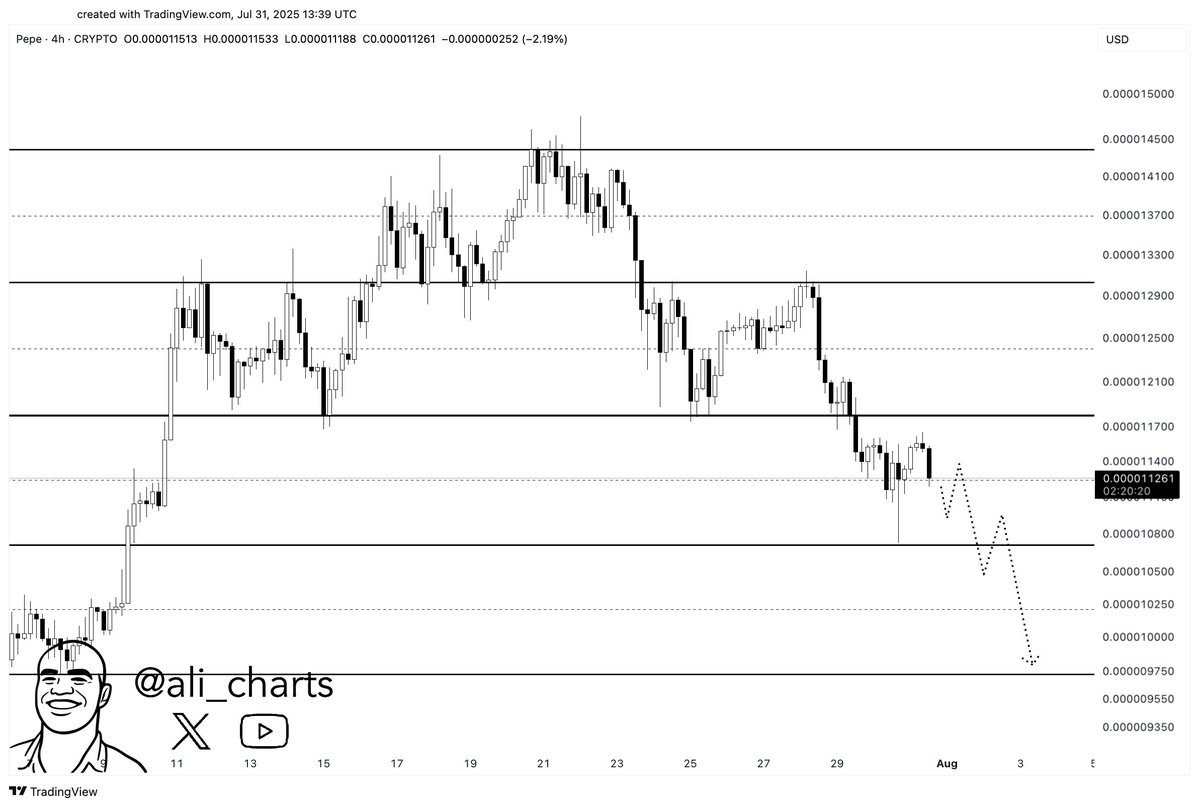

Lastly, the analyst warns that Pepe (PEPE) may have a massive correction if the memecoin fails to reclaim a key level as support.

“PEPE needs to reclaim $0.0000118 as support to avoid a potential drop to $0.0000097!”

PEPE is trading for $0.00001072 at time of writing, down 4.6% on the day.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Salamahin/Kiselev Andrey Valerevich