Pi Network developers are gearing for the highly-anticipated mainnet launch, which is expected to happen in March.

This mainnet launch will allow pioneers to monetize their accumulated tokens and developers to showcase their apps to their target audience.

The launch will happen over seven years since the developers launched the network, which allowed pioneers to mine tokens on their smartphones.

A lot has not been revealed about the mainnet launch, including the date and the price. Speculation is that the Pi coin price will start trading at $3.14, the value of pi. Here are the three reasons why the Pi Network price may crash after the mainnet launch.

Pi Network price may drop because of revenge selling

The first main reason why the Pi coin price may crash after the mainnet launch is revenge sellng. This is a situation where pioneers who have been mining the token for years decide to sell all their tokens.

That’s because these pioneers have endured a prolonged wait for the mainnet launch to happen. They missed the recent crypto price surges in 2021 and in the last three years.

Pi Network’s developers have also disappointed them by missing key deadlines. For example, they delayed the know your customer verification or KYC from November 31 last year to February 28.

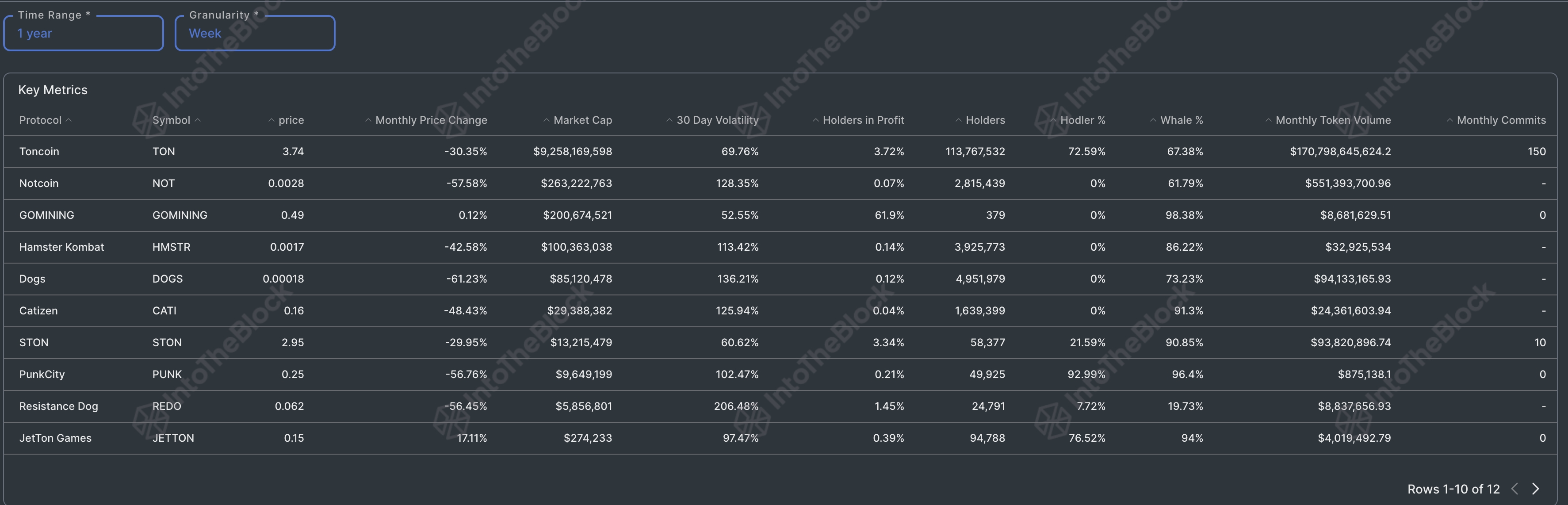

Tap-to-earn tokens crash after the airdrop

The other reason why the Pi con price may crash after the airdrop is that many tap-to-earn tokens crash after their airdrop. Hamster Kombat (HMST) has crashed by 90% from its highest level in September last year.

Other tokens like DOGS and Notcoin have also dropped. This is notable since Pi Network is a tap-to-earn platform where users accumulate tokens by tapping a button on the app. The only difference is that Pi has created its own blockchain and its ecosystem, including a browser and the Fireside Forum.

These tokens crash as many users who have accumulated their tokens sell and convert them into fiat currencies.

It is not just tap-to-earn tokens that have crashed after the airdrop. Most recently airdropped tokens like Berachain, Wormhole, and zkSync have all plunged after their token launches.

As such, many Pi Network pioneers will want to sell early to avoid the mistakes of most tap-to-earn holders.

Seasonality to play a factor

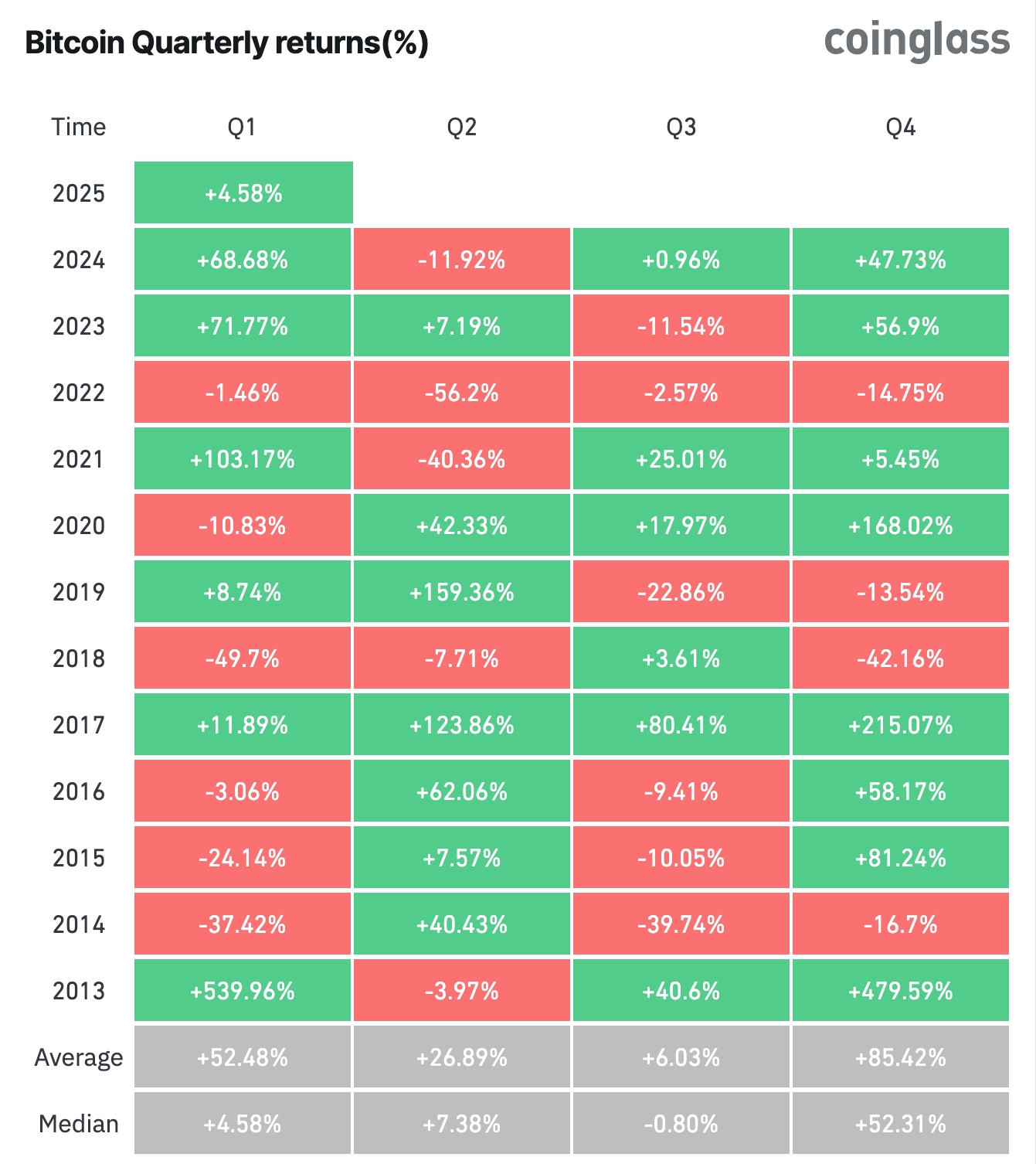

Further, Pi Network mainnet launch may happen in the last days of the quarter. Historically, the third quarter is usually the second-worst period for cryptocurrencies since it coincides with the Summer season. CoinGlass data shows that the average Bitcoin return in Q2 is 26%, followed by 6% in Q2.

Therefore, there is a risk that the Pi coin price will drop if the seasonality aspect works. Newly launched airdrops do well when there is a crypto bull run.