Peter Schiff opened fire on X by declaring Michael Saylor the “biggest con man on Wall Street” and calling Strategy’s business model a fraud.

Naturally, this served as the perfect segue into his favorite topic: Bitcoin is a “fake” asset.

Summary

- Schiff calls out Michael Saylor and Strategy while insisting Bitcoin is a “fake asset.”

- BlackRock’s Bitcoin ETFs are thriving, with IBIT nearing $100B in assets despite market dips.

- Corporations and central banks are actively buying Bitcoin, proving the “end” isn’t exactly trending.

On Monday, Dec. 1, Schiff called out Saylor and didn’t mince words:

“Today is the beginning of the end of $MSTR. Saylor was forced to sell stock not to buy Bitcoin, but to buy U.S. dollars merely to fund MSTR’s interest and dividend obligations. The stock is broken. The business model is a fraud, and Saylor is the biggest con man on Wall Street.”

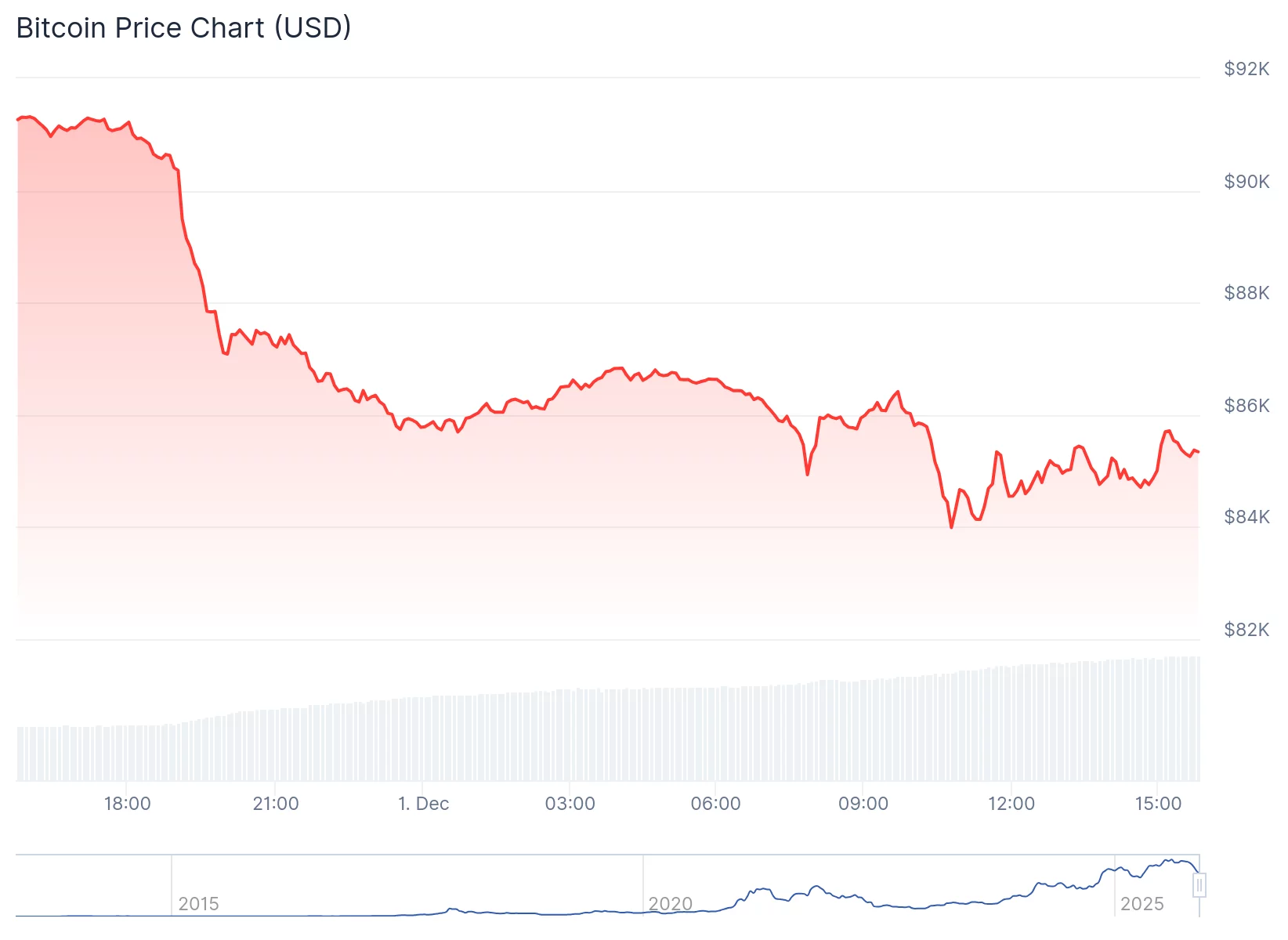

Schiff also pointed out how the cryptocurrency slid 28% from all-time highs, while the Nasdaq sits just 2% below its peak. November’s $500 billion wipeout, he argues, is proof that investors are fleeing what he sees as an imaginary asset and racing toward “real ones.”

Bitcoin: ‘Stronger’ than ever?

Bitcoin is breaking down again, Schiff posted late Sunday. Over the past 24 hours, the world’s top digital asset has been in the red, down over 6% at last check.

Last month, Saylor seemed unfazed but the sudden market downturn and remains confident despite Bitcoin’s recent pullback.

Strategy, previously known as MicroStrategy, can handle extreme declines and is “engineered to take an 80–90% drawdown,” he said on Fox Business. Bitcoin will gradually decline further, Saylor predicts, adding that it will stabilize at roughly 1.5 times the S&P 500’s volatility while outperforming it proportionally, concluding that “Bitcoin is stronger than ever.”

He treats the drop from $110,000 to $81,000 as a personal victory lap — and boy, is it punchy.

Saylor vs. Schiff: Who’s right?

BlackRock’s Bitcoin ETFs — barely two years old — are now the firm’s most profitable product line, with IBIT climbing toward $100 billion in assets. Inflows continued even during November’s slump.

Robinhood is considering holding Bitcoin on its balance sheet, Kazakhstan’s central bank plans a $300 million crypto allocation, and corporations from Strategy to Metaplanet are treating Bitcoin as a strategic asset, not a meme.

Volatility? Sure. Dead? Not so much. For the moment, Wall Street sees revenue and governments see opportunities.

Indeed, Schiff is loud, but the capital flows are louder.