Chainlink’s price rallied over 50% in the past week amid ongoing whale accumulation and growing adoption of its ecosystem by more institutions.

Summary

- LINK is up over 50% this week and has hit a 7-month high of $24.28 today.

- Chainlink has recently partnered with Intercontinental Exchange to provide onchain pricing data for FX and precious metals.

According to data from crypto.news, Chainlink (LINK) surged to a 7-month high of $24.28 on Wednesday, Aug. 13, morning Asian time. The recent surge brought its weekly gains to over 50% and 123% from its lowest point this year, while bringing its market cap to over $16.4 billion.

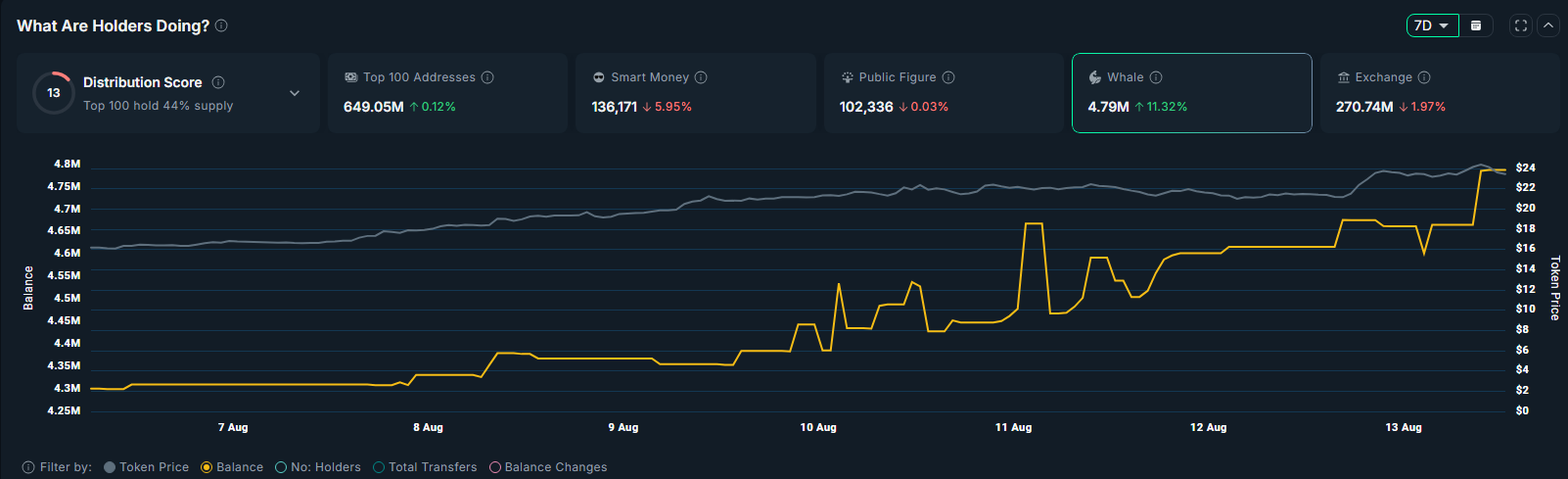

Whales are buying LINK

LINK strong gains are tied to multiple catalysts, including sustained interest from whales this week.

Data from Nansen shows that the balance of LINK tokens held by whale wallets has increased by 8.5% over the last 7 days. These addresses now hold 4.65 million tokens, up from 4.29 million recorded on Aug. 6 and significantly higher than 3.42 million seen in mid-May this year.

Whale accumulation is typically seen as a bullish signal by retail investors, who often follow these deep-pocketed investors in building their portfolios. Such buying could lead to further appreciation of the asset’s price, especially if accompanied by strong market sentiment and positive fundamental developments.

One such development is the growing adoption of Chainlink’s Cross-Chain Interoperability Protocol (CCIP) by major financial institutions. An official blog post from Chainlink revealed that the protocol has been integrated with Swift, the international bank messaging network used by over 11,500 institutions, to connect banks directly to blockchains.

This integration allows financial institutions to interact with both public and private blockchains using their existing Swift infrastructure and messaging standards, streamlining interoperability and settlement processes.

The trial featured more than a dozen leading institutions, including Euroclear, Clearstream, ANZ, Citi, BNY Mellon, BNP Paribas, Lloyds Banking Group, and SIX Digital Exchange (SDX).

A more recent development is that Chainlink joined forces with Intercontinental Exchange, the parent company of the New York Stock Exchange, to deliver real-time onchain pricing feeds for foreign exchange and precious metals.

LINK price analysis

On the weekly chart, LINK has formed a multi-month ascending broadening wedge pattern. This structure consists of two diverging trendlines sloping upward, indicating increasing price volatility over time.

More recently, LINK has confirmed a double-bottom formation. The two bottoms were established at $10.9, with the neckline positioned at $18. A breakout above this neckline has historically signaled a bullish reversal, suggesting the potential for further upside momentum.

The 50-day moving average currently sits above the 200-day moving average, indicating a bullish trend bias in the medium to long term.

An ascending broadening wedge is generally seen as a bearish setup linked to distribution phases, yet LINK’s price is moving toward the upper trendline near $40, roughly 65% above its current level.

Some analysts see the potential for a move toward $46 in the coming weeks, if heavy trading activity and elevated demand continue to support the rally. See below:

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.