Ethereum price rallied over 19% in the past week. With the price now only 12% below its all-time high, traders are watching for potential signs to gauge direction as the market heads into a pivotal week.

Summary

- Ethereum has gained over 19% in the past week, and is trading just 12% below its all-time high.

- Spot Ethereum ETFs recorded a record $1 billion in net daily inflows

- Key U.S. economic data set to be released this week could shape ETH price trajectory.

Ethereum (ETH) breached the $4,000 resistance level earlier this week for the first time since December last year. Following the breakout, the altcoin rallied to a weekly high of $4,329 before settling at $4,303 at the time of writing, still holding gains of over 19% over the past seven days.

Zooming out on the chart, its recent rally has extended its year-to-date gains to over 190% and pushed it 7.2% above its December high from last year.

With ETH now just 12% away from hitting a new all-time high, let’s look at a few factors that could determine whether the rally continues or a price correction takes hold in the days ahead.

ETH confirms key bullish pattern

Ethereum formed a multi-year megaphone pattern on the weekly chart, characterized by a series of higher highs and lower lows that expand over time.

Last week, the price broke decisively above the pattern’s upper trendline, signaling a potential acceleration of bullish momentum.

Since breaking out, ETH has been trading well above all major moving averages. The 50-day moving average remains above the 200-day moving average, which confirms that a long-term bullish structure is intact.

Momentum indicators were also flashing bullish signs with the MACD lines trending upward and histogram bars expanding.

ETH could extend its rally over the coming months toward $7,000, 62% above the current price level, if the current momentum persists.

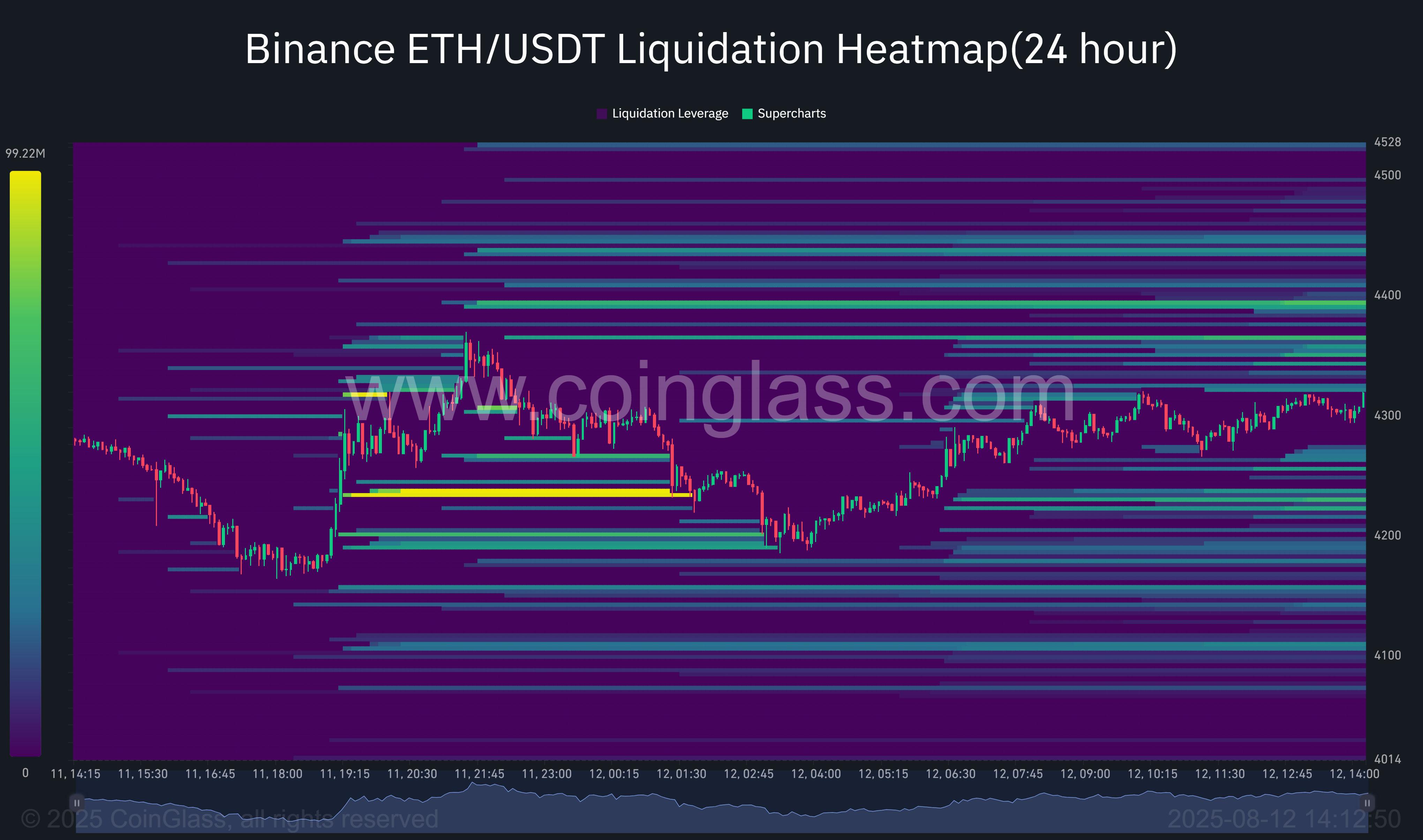

Examining liquidation levels offers a more grounded perspective on Ethereum’s potential trajectory.

According to data from CoinGlass, a large concentration of liquidation levels exists between $4,200 and $4,300, with further clusters around $4,400–$4,500. These zones often act as short-term price magnets.

On the downside, notable liquidation levels are visible near $4,100–$4,150, which could accelerate declines if the price retraces.

Spot ETF inflows expected to support uptrend

Spot Ethereum ETFs brought in $1 billion in net inflows yesterday, the largest single-day total since these investment products launched. After two quiet weeks, the sudden jump in inflows signals a sharp turnaround in investor sentiment toward the asset.

If these strong inflows persist, the momentum could draw increased attention from retail investors, potentially amplifying demand and fueling further price appreciation over the coming weeks.

Profit-taking could trigger short-term pullback

With Ethereum breaching the $4,000 level and posting strong gains over the past week, early investors may be looking to offload their ETF holdings to lock in profits.

Data from onchain analytics platform Glassnode shows that short-term Ether holders have been taking profits more aggressively than long-term holders, suggesting that some traders may be anticipating a near-term pullback.

Such behavior is common in the crypto market after an asset reaches multi-month highs. If profit-taking continues at the current pace, Ethereum could experience a temporary decline before attempting its next move higher.

Macro factors expected to impact sentiment

This week, investors will also be following a packed U.S. economic calendar, which could heavily influence risk assets like Ethereum.

The July CPI report will be released on Tuesday, followed by the PPI on Thursday, and retail sales and consumer sentiment on Friday. These data are expected to shape Fed rate cut expectations.

If the data shows softer inflation in play, the Federal Reserve may view it as support for cutting interest rates sooner. Lower rates generally boost market liquidity, which can make risk assets like Ethereum more attractive to investors and potentially drive prices higher.

Bitcoin correction can impact ETH

Bitcoin’s rally to over $122k over the weekend liquidated over $100 million in short positions and pushed prices just below all-time highs, but it also left behind a new CME futures gap near $117,200. Historically, such gaps are often “filled” as price retraces to those levels.

Traders are closely watching this area for a potential pullback, as BTC often retraces to fill such gaps. A move toward $117,200 could prompt broader market consolidation, which in turn may put short-term pressure on altcoins like ETH.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.