Japan’s 40Y Bond Yield has hit 2.85%, dangerously close to its historic 3% high. Japan’s predicament could cause a trickle-down effect that can spike U.S. yields and eventually send the crypto market into a downward spiral.

According to data from Trading Economics, Japan’s 40-year Bond Yield peaked at 2.85% on March 10, based on over-the-counter interbank yield quotes. The site states the last time Japan’s 40Y Bond Yield reached an all-time high of 3% was in January 2011. However, Bloomberg noted that it also reached that level in January 2024.

Japan is the holder of the world’s largest debt pile, which is more than double its $5 trillion-valued economy. Rolling over that debt at higher yields will require higher costs, and with the Bank of Japan owning around 70% of their government bonds, markets might start doubting its sustainability

For decades, Japan’s monetary policy has kept their rates extremely low. However, the spike in Japan’s 40Y Bond Yield could signal a shift in inflation and interest rates domestically. If yields continue to rise and potentially reach the 3% high, it may lure Japanese investors back to domestic yields and away from U.S. yields.

For context, Japan is one of the largest foreign holders of US Treasuries. As Japanese yields become more attractive, Japanese investors might prefer them over U.S. debt that offers lower yields. This could reduce demand for U.S. Treasuries, which could lead to higher U.S. yields as the U.S. government attempts to compete.

An uptick in U.S. yields could mean a rise in borrowing costs for both government and private corporations. Not only that, elevated yields could strengthen the U.S. dollars alongside U.S. Treasuries.

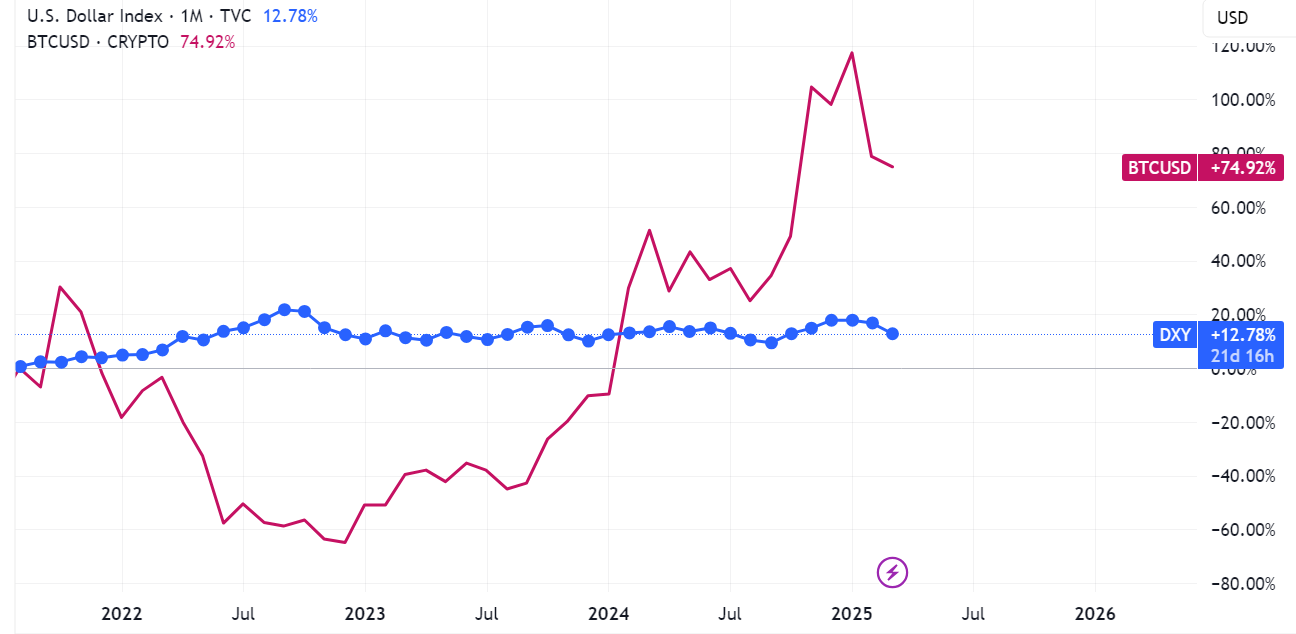

As seen on the chart above, the U.S. dollar index and the crypto market (represented by the staple Bitcoin (BTC) price) have an inverse relationship. Therefore, when the dollar goes up, crypto tends to go down.

When conventional assets like the dollar and U.S. Treasuries offer better returns, investors might flock towards them and divert their funds away from riskier alternative assets, such as stocks and the crypto market. Additionally, rising yields on government bonds could also indicate tighter global liquidity.

For the crypto market, which usually benefits from loose monetary conditions and ample liquidity, this monetary shift could be catastrophic. Crypto markets are particularly sensitive to shifts in global liquidity and risk sentiment, therefore this shift could result in increased volatility and downward pressure for crypto assets.

With investors pulling their funds away from risky assets, it could eventually reduce inflows into crypto the crypto market, resulting in a drag on crypto prices.

Overall, Japan’s 40Y Bond Yield could spell trouble for the crypto market. The shift in monetary conditions led by the Japan’s 40Y Bond Yield reaching its 3% high could strengthen the dollar, tighten global liquidity, and reduces investor capital flowing into riskier assets like crypto.