Estimated reading time: 13 minutes

In this article, we will be talking about margin trading on the BYDFI exchange. We will tell you about various features and guide you with detailed steps for margin trading at BYDFI.

Summary (TL;DR)

- You can use BYDFI‘s margin trading services both in commodity derivatives and crypto-assets.

- By trading in the derivatives market, you invest in an underlying commodity with rights to exchange it at a fixed price in the future.

- At BYDFI, you get maximum leverage of 125x on crypto and 200x on derivatives.

- BYDFI offers many features such as Floating P&L, SL ratio, TP ratio, Leverage slider, etc.

- You can easily customize the margin trading window at BYDFI.

- BYDFI charges you with no interest but a high fee on margin trading.

To learn more about BYDFI, watch out video below:

What is margin trading?

Margin trading allows you to trade with borrowed funds and with your initial capital as collateral. This way, you can increase your investment with a smaller capital and increase your returns. The exchange usually charges you interest or an overall trading fee for the borrowed funds.

To learn about margin trading basics, you can read our guide on margin trading.

Margin trading at BYDFI

BYDFI offers isolated margin trading with a customizable easy to use interface.

At BYDFI, you do not need to complete your KYC or activate your margin trading account to start trading on margin. All you need to do is create an account and deposit funds to your BYDFI wallet.

Contracts offered by BYDFI

Contracts are an instrument that allows you to trade on the price movements of assets. These assets include commodity derivatives such as gold, silver, crude oil, etc., as well as crypto assets such as BTC, ETH, etc.

Unlike the spot market, contract trading allows you to trade on assets without actually owning them. While HODLing an asset, you get a significant return in weeks or even months. In comparison to that, by trading digital contracts on BYDFI, you can take returns daily.

What is derivatives margin trading?

Derivatives represent assets such as crude oil, gold, silver, copper, etc., and you can trade on any of these. While buying commodity derivatives, you buy the rights without actually possessing the commodity.

The seller gives you the commodity’s ownership to exchange it in the future at a specific price. You then try and earn a profit based on the spot price of the commodity.

There are 11 commodities available at BYDFI for margin trading. Since derivatives are not as volatile as cryptocurrencies, you get a higher maximum investment level of 40,000 USDT for crude oil.

_-BYDFI-CFD-Google-Chrome-31-08-2021-21_49_05-2-1024x428.png)

_-BYDFI-CFD-Google-Chrome-31-08-2021-21_49_05-2-1024x428.png)

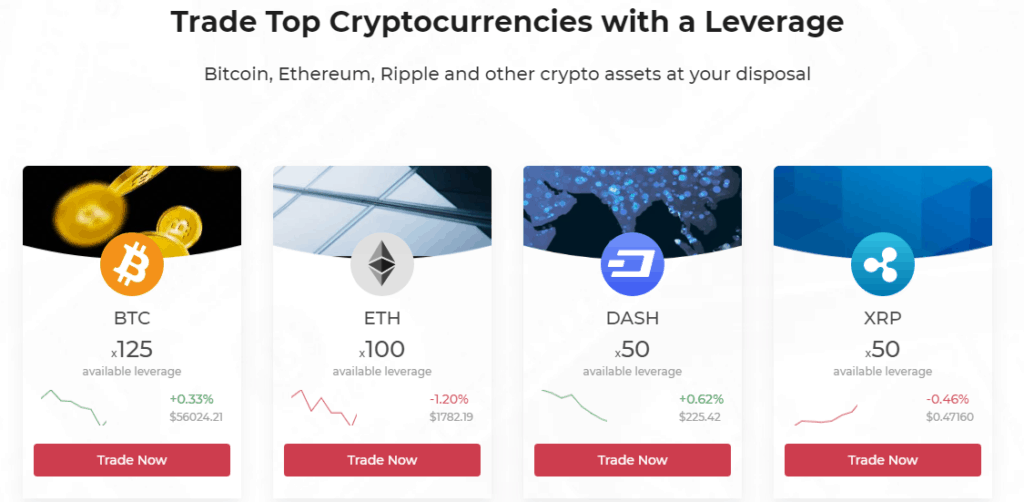

What is crypto margin trading?

The second option for margin trading would be cryptocurrency. BYDFI offers margin trading in 13 crypto assets and a maximum margin of 20,000 USDT for BTC as of March 2021. There are different upper and lower limits for other crypto assets.

Leverage in Crypto and Derivatives

Leverage determines the loan you will be receiving from BYDFI. Suppose you choose a leverage of 10x with an initial capital of 1USDT. Then the platform will lend you 9 USDT, making it ten times your capital.

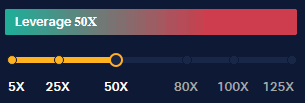

You get maximum leverage of 125x on crypto assets. However, BYDFI offers maximum leverage of 200x on derivatives.

BYDFI offers isolated margin trading

BYDFI only offers isolated margin trading, which beginners usually prefer. Isolated margin trading helps you prevent liquidations and hence from losing all your funds in a market fall. To understand isolated margin trading, let’s have a look at an example.

How does isolated margin trading work?

Let’s assume you have 10 USDT in your BYDFI wallet. Now you open a position worth 5 USDT in the BTC market with a leverage of 50x. Suppose the value of BTC dropped by 3%, and your funds are about to liquidize.

Now, you can either deposit more funds or let your capital liquidize. Even if your funds liquidize, you don’t lose any more than your initial capital for that particular position, which is not the case with cross-margin trading.

Margin trading at BYDFI: Definitions

BYDFI has a series of features and options on its margin trading window. Here we will try to explain to you all of these features one by one:

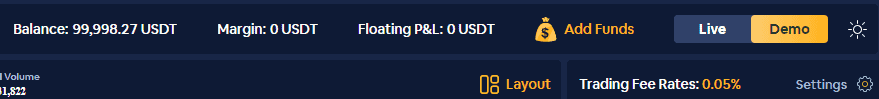

Balance

The balance represents your total account balance. When you open a position, your balance does not include your capital for that position.

Margin

The margin shows the total amount you’ve used as the capital until you close a position.

Floating P&L

Floating P&L shows the combined value of return from all of your open positions. It can be zero, positive, or negative, showing no returns, profit, or loss.

Limit Order

Limit allows you to place orders beforehand, which execute when the market meets your order requirements. You can even change your order if you find a better opportunity in the market.

Market Order

When you place a market order, all your positions open and close in real-time. You can only close the position after opening it and cannot alter the order details once you successfully open a position.

Difference between live and demo platform

BYDFI offers a demo trading platform, which helps beginners to learn margin trading without risking their real assets. Using the demo tab, you can open and close positions without any capital. On the other hand, going live means trading with real capital as collateral and hoping for a return.

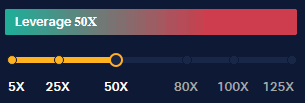

Leverage slider

It is a slider on the right side of your margin trading window. The leverage slider allows you to adjust your leverage anywhere between its limits. However, you can also directly enter a value of leverage you desire in the box below.

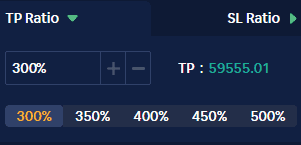

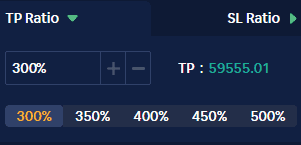

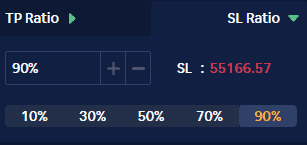

TP ratio

You will find this option on the right side of your trading window. TP ratio allows you to know the closing value of a position with your desired return. You can either enter a % or the return you expect from a particular position.

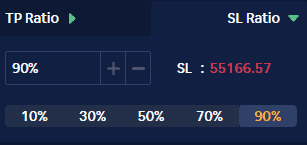

SL ratio

You can click on the SL ratio from the right side of the BYDFI margin trading window. The SL ratio tells you the exact value of your open position. You can close the position at that value to not incur any losses after a limit of your choice.

Equity

On the BYDFI mobile app, by clicking on position, you will see a term called equity. Equity combines your balance, margin, and Floating P&L to tell your real-time account balance.

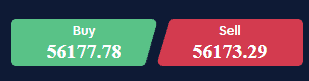

How to go long on BYDFI?

Going long means opening a position that predicts a rise in the asset’s value. You can open a position by clicking on the Buy/ Long/ green button on the screen’s right side.

How to go short on BYDFI?

Short selling means opening a position that predicts a fall in asset value. By going short, you sell the lender’s asset at a higher price. And then, when the price lowers, you repurchase it and return it to the lender.

Since it a complex process, hence BYDFI keeps you away from it and allows you an easy option to go short. You can open a short position by just clicking on the Sell/ Short/ red button on the screen’s right side.

Customize layout at the BYDFI margin trading window?

BYDFI allows you to customize your layout. You can click on the ‘Layout’ button at the top right corner of the graph, or you can hold and drag the particular tabs at your preferred location.

How to start with margin trading at BYDFI?

For your ease, we thought of providing you with a detailed step-by-step guide for margin trading at BYDFI. You can follow these steps for both derivatives as well as for cryptocurrencies.

Step 1: Sign up

To begin with margin trading, you must have an account at BYDFI, and you can follow these steps to create one:

- Visit BYDFI’s official website and click on sign-up.

- Now enter your email and password.

- On the next window, verify your email by entering the code sent on your email.

- It is not mandatory to complete your KYC. However, if you wish to do so, follow the below steps.

- After logging in, go to your profile tab and click on Real name verification.

- Now enter your passport or government-approved ID details.

- Now upload pictures in JPEG or PNG format and wait for BYDFI to complete the audit process.

Step 2: Deposit funds

To begin with, in any type of trading, you need to deposit funds. BYDFI does not accept FIAT.; hence you need to buy the accepted currency from your local exchange and then deposit them in your BYDFI wallet.

You can follow these steps to deposit funds at BYDFI:

- Hover on assets in the header and click on deposit.

- Now choose an asset to make a deposit.

- Read the terms of deposit carefully.

- You can then either scan the QR code or copy the wallet address.

- Remember only to send a particular asset to its specific wallet address. Sending a currency at a different address can lead to a loss of your asset.

Step 3: Crypto margin trading

You can follow these steps to begin derivatives/ crypto margin trading at BYDFI:

- Hover on the contract and click on crypto/ derivatives as per your choice.

- From the left side of the screen, click on the asset you wish to trade marginally.

- Now enter your margin and choose leverage from the right side of the window.

- Click on long/ short to open a position.

- You can click on the close button at the bottom of the screen to close a position.

BYDFI Margin Trading Fee

BYDFI charges a trading fee of 0.05 % on all crypto margin trading orders. In contrast, there is a 0.025% margin trading fee on derivatives.

BYDFI also charges an overnight fee on cryptocurrencies. However, there is no overnight fee on derivatives.

Fee calculation

For crypto assets:

Trading Fee: (Margin * Leverage * 0.05%)

Overnight Fee: (Margin * Leverage * 0.05%)

For derivatives:

Trading Fees: (Margin * Leverage * 0.025%)

Margin trading rules at BYDFI

BYDFI has some margin trading rules, which are as follows:

- There is a minimum margin limit of 5 USDT for all of the assets, including derivatives.

- The upper limit varies depending on the asset. There is an upper limit of 40,000 USDT on crude oil, whereas only 20,000 on USDT on BYDFI.

- All the positions are auto-close at 05:55:00 SGT.

- The trading hours are around the clock, i.e., 24×7.

Risks involved in margin trading

- The most significant risk in margin trading would be liquidation.

- The higher leverage you use, the higher your losses would be if the market goes sideways.

- The exchange can sell your capital without informing you in case of liquidations.

- You do not get a margin call at BYDFI, so you shouldn’t leave your screen with an open position.

BYDFI margin trading: Pros and Cons

| Pros | Cons |

|---|---|

| BYDFI provides you with one of the highest leverage among all crypto margin trading exchanges. | They have a high trading fee, which justifies no interest rate. |

| They support isolated margin trading, which prevents you from losing more funds than your capital. | The platform does not provide an option for cross-margin trading. |

| BYDFI has licenses from four different countries. | You can only use USDT for margin trading. |

| The platform has a customizable and easy-to-use interface. | |

| They do not charge interest on your loan amount. |

BYDFI Margin Trading: Conclusion

BYDFI makes margin trading simple with its user-friendly interface. The platform offers isolated margin trading with no interest on loans. However, you have to pay a significant trading fee and overnight fee. Therefore, BYDFI is one the of these best Bitcoin margin trading exchange our there.

Margin trading is an excellent opportunity for investors with less capital and willing to take higher risks. Always remember, a wrong decision in margin trading can lead you to lose all your money.

Frequently Asked Questions

How does crypto margin trading at BYDFI work?

After you choose to leverage and enter a margin, then the platform lends you the remaining amount to open a position. When you close a position, the exchange automatically deducts your borrowed amount and transfers it to your account.

What is the difference between long and short in margin trading?

By going long, you predict a rise in the asset’s value, and by going short, you are predicting a loss in the asset’s value.

What does 5x leverage mean?

Suppose you enter a margin of 5 USDT with a 5x leverage. Then you will be opening a position worth 25 USDT, and the exchange will provide you the remaining funds.