Ethereum’s price plummeted to a nearly five-month low of around $2,300 on Monday morning in Asia as the specter of a global trade war triggered a risk-off sentiment, unsettling investors.

Ethereum (ETH) fell 23.6% to an intraday low of $2,368 on Feb. 3 Asian morning after U.S. President Donald Trump announced trade tariffs on China, Canada, and Mexico over the weekend.

Higher import tariffs could drive up inflation, potentially leading to higher interest rates. This, in turn, triggered a risk-off sentiment, which pressured cryptocurrency prices.

As of press time, the altcoin market fell 28% to nearly $1.07 trillion, with several major altcoins like XRP (XRP), Solana (SOL), Dogecoin (DOGE), and Cardano (ADA), among others recording losses between 15-30% over the past day.

Ethereum experienced its largest liquidation event in the past two years, with $475.72 million liquidated from long positions and $127.78 million from short positions over the past 24 hours. During the same period, open interest in its futures market fell 27% to $23.36 billion, while its funding rate dropped to levels last seen during the March 2020 COVID crash.

The sharp drop in Ethereum’s open interest suggests traders are pulling back from leveraged positions, likely due to heightened market uncertainty.

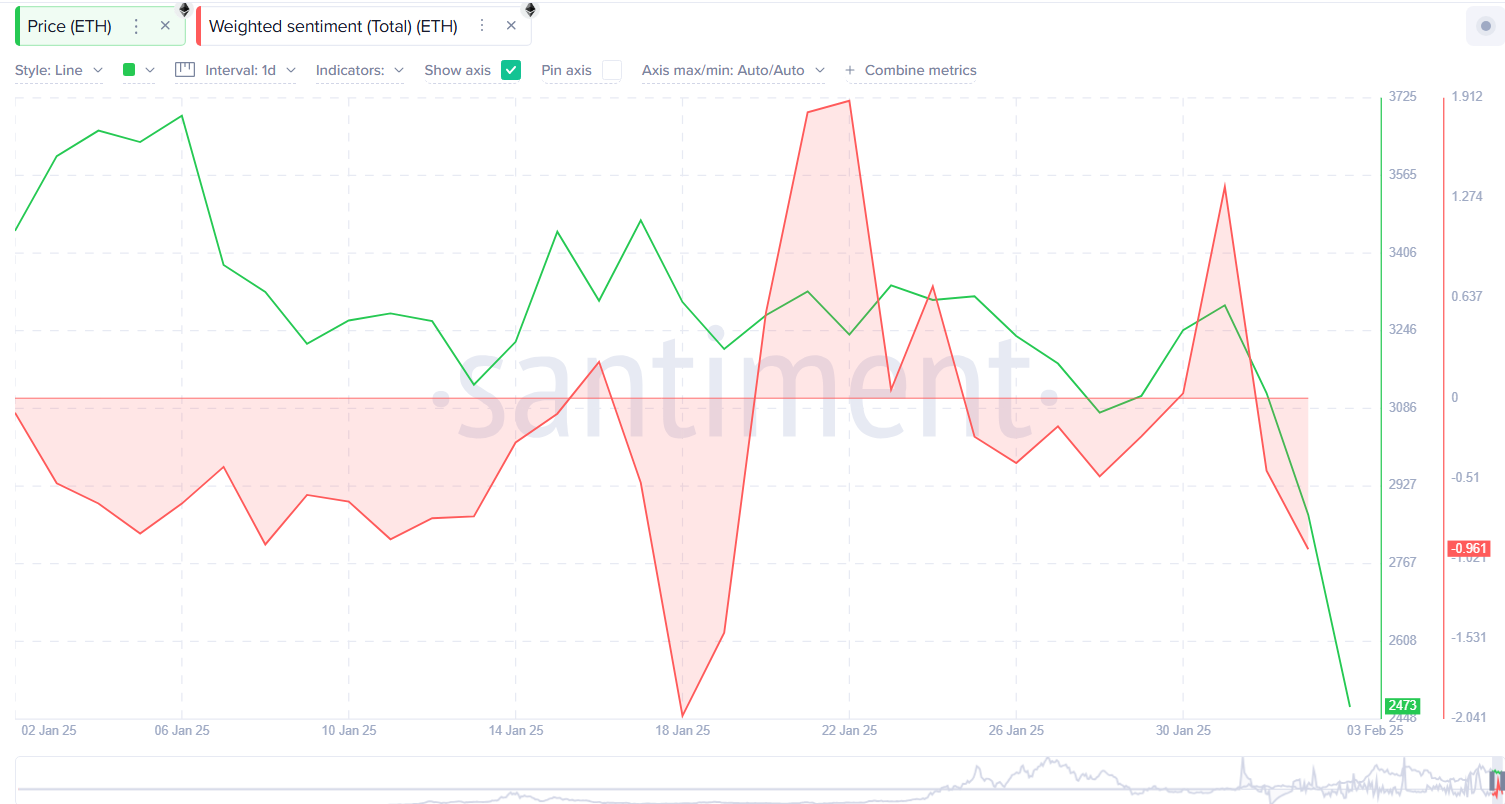

Aligning with this, the weighted social sentiment for ETH has turned negative per data from Santiment.

ETH technical analysis

On the daily USDT chart, ETH has moved below the 50-day and 200-day moving averages, signaling a strong short-term bearish trend.

Further, the Aroon indicator shows the Aroon down at 100% while Aroon Up showed a reading of 0%, which means the asset could potentially see further losses over the coming day.

However, the Relative Strength Index, with an oversold reading, suggests that selling pressure on ETH may be easing. Typically, an asset experiences a bullish reversal once it has hit its bottom. This trend can be confirmed if ETH makes its recovery back above the 200-day moving average.

ETH could rebound

Despite the sharp sell-off, signs of dip buying are emerging, hinting that some investors see the pullback as a buying opportunity rather than a prolonged downturn.

Investors have withdrawn $326.7 million worth of ETH from exchanges over the past three days, according to data from CoinGlass. Typically, such outflows suggest that investors are accumulating during the dip, anticipating a price recovery once bearish pressure eases.

Whales have also begun buying the largest altcoin following its recent price plunge. According to a Feb. 3 X post from Onchain Lens, a whale purchased 35,494 ETH, worth nearly $88 million.

In a subsequent post, the platform reported another whale buying $1 million worth of $ETH following the recent dip.

In comments to crypto.news, Georgii Verbitskii, Founder of TYMIO, speculated that ETH could see a short-term bounce toward $2,700, driven by technical factors and temporary relief in market sentiment. However, he noted that Ethereum has struggled in recent days and, without strong catalysts or fresh narratives, it is likely to remain weak against Bitcoin.

“If global tariff concerns escalate or another wave of negative news hits the market, we could see one more leg down before ETH finds more stable ground,” he added.

Meanwhile, analyst Ali Martinez identified an ascending parallel channel in Ethereum’s price action on the 3-day chart. He noted that ETH must hold the $2,750 support level to sustain its trajectory within the channel. If this level holds, Martinez projected a potential rebound to $6,760.

At press time Ether was still own 18.4%, exchanging hands at $2,541 per coin.